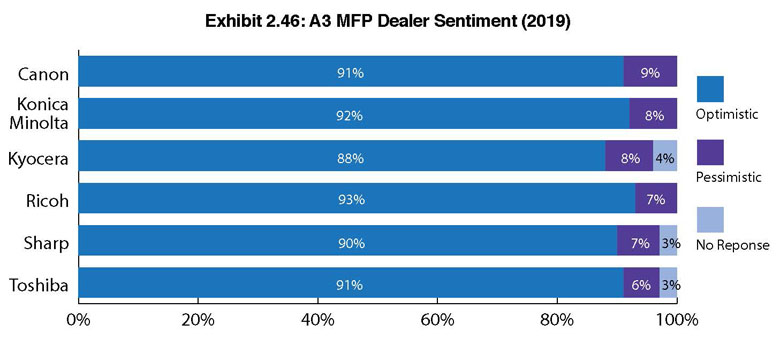

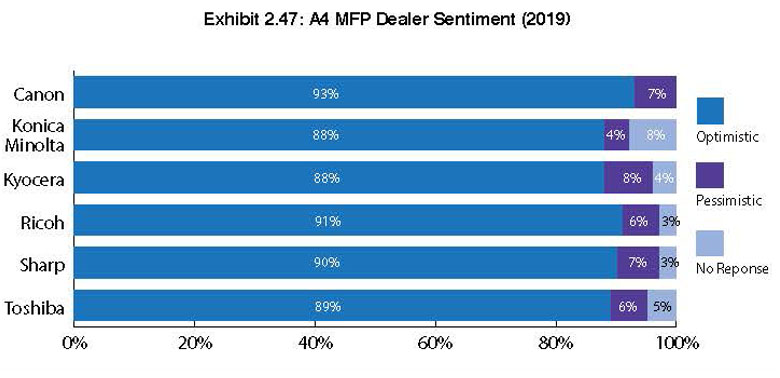

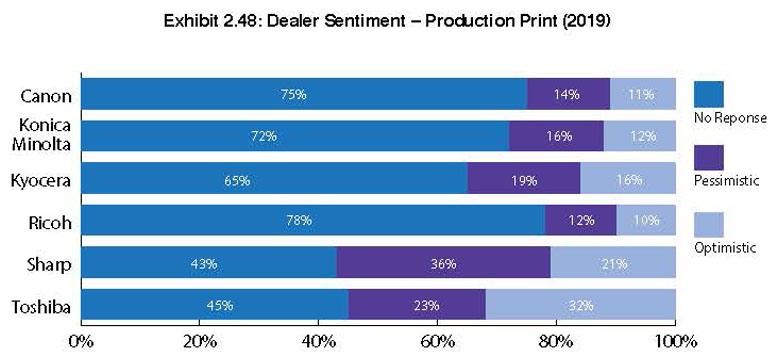

This is the third year where we have tracked dealer optimism and pessimism in three areas—A3, A4, and production print. Not every dealer responded to this Survey question, and for accuracy, we include the no responses in our percentage calculations. The number of no responses are small for A3 and A4, but higher when we ask about production print, primarily because most dealers that did not respond aren’t engaged in this segment of the business.

For Big Six dealers whose core business is A3 MFPs, 90% are optimistic despite the challenge presented by declining clicks and tighter margins, as well as pressure to expand their product offerings beyond A3. That’s a negligible 1% increase over last year. This year, 7.5% said they were pessimistic, down from 9% last year, while less than 2% offered no response. You’ll find the most optimistic dealers in the A3 space representing Canon (93%) and Ricoh (91%). The least optimistic dealers in this year’s Survey are Kyocera (88%) and Sharp (90%). What we find interesting is that last year, Canon dealers were the least optimistic (85%) and Kyocera dealers the most optimistic (95%). It seems as if there’s some uncertainty around the new leadership at Kyocera and some of the changes that have been made of late, including personnel changes. That could be impacting the sentiments of Kyocera dealers. Canon, on the other hand, seems to be improving its communication with dealers and continuing to offer a strong product line, and those two factors have been a plus.

Looking at A4 optimism, Canon (93%) and Ricoh (91%) scored the highest among dealers representing those two brands. We were surprised to see Kyocera’s rating drop from 96% in last year’s Survey to 88% this year. The company has a strong track record of excellence in A4 and historically, our Survey results confirm that. This decline could also be attributed internal changes within the company. Konica Minolta also had an 88% rating, which we attribute to the company’s focus on the higher end of the technology curve. Overall, 90% of Big Six dealers are optimistic from an A4 perspective, a 3% increase from last year. Six percent were pessimistic overall, and 4% did not respond. It’s worth noting again that when it comes to A4, dealers have not readily embraced this segment because of its low price. However, that seems to be changing, driven partly by customer demand.

When asked how optimistic dealers were about production print, the results were pretty much where we expected them to be, considering this is still an emerging product segment for many dealers. The average percentage of optimism among the Big Six was 63%, up 2% from last year, with 20% saying they were pessimistic, down from 23% last year, and 17% did not respond.

When we track the ratings of the haves (Canon, Konica Minolta, Ricoh) and the have nots (Kyocera, Sharp, Toshiba) in the production space, there is a huge discrepancy in the amount of optimism. Here, 75% of dealers representing the haves are optimistic, while only 51% of the have nots are optimistic. Driving that percentage down are Sharp (43%) and Toshiba (45%) dealers. Kyocera dealers are trending upwards in their optimism around production print. Last year, 55% were optimistic, this year, 65%.

Could this be the result of finally having access to a production print device? We think so.

Overall, the degrees of optimism in A3, A4, and production, lead us to believe dealers are enthusiastic about the products they are selling. It’s still a good time to be a dealer, despite the abundance of acquisitions and the uncertainty that brings. Reflecting on the entirety of our Survey results, it is clear dealers are keenly aware that in order to create a sustainable dealership, diversifying beyond the core A3 business is now a necessity.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.