This is the era of acquisitions. News of acquisitions may not be flowing in daily, but hardly a week goes by when an acquisition isn’t announced. Most of those acquisitions are primarily of smaller dealers, although Flex Technology Group has raised the bar on the size of dealers it has acquired in terms of revenue. It’s not unusual for Flex Technology Group to acquire dealers with $20-plus million in revenues, as opposed to other dealers that are mostly acquiring companies with less than $2 million in revenues.

Without a doubt, the biggest deal of the year has been Staples acquisition of DEX Imaging. A big dealer and an active acquirer, the DEX acquisition is a game changer, signifying that no matter how large the dealership, it is a target for acquisition. Didn’t we see something similar happen with Marco when it was acquired by Norwest Equity Partners in 2015?

There’s no denying that private equity money is reshaping the dealer landscape. Flex Technology Group, Marco, UBEO, Visual Edge, and now, DEX Imaging under private-equity owned Staples, are acquiring after being acquired themselves by private-equity firms.

While the independent dealer landscape is being impacted by acquisitions, let’s not ignore the acquisitions taking place in the vendor space. This year alone, Ricoh acquired DocuWare, Kofax acquired Nuance, and EFI was acquired by private equity. Those are all big players, further signifying that no entity is immune to acquisition.

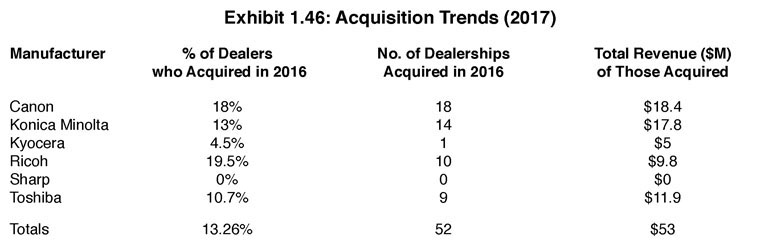

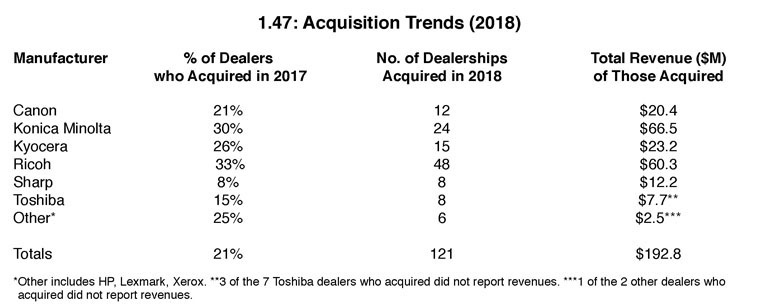

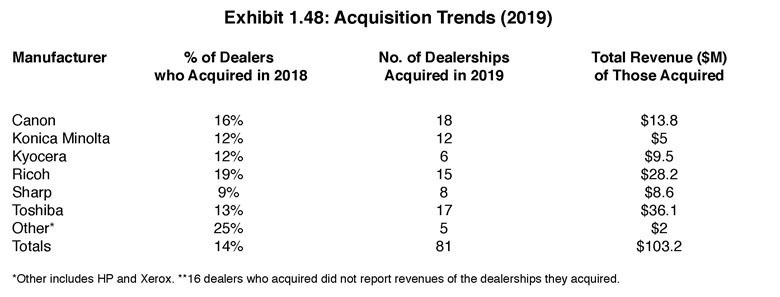

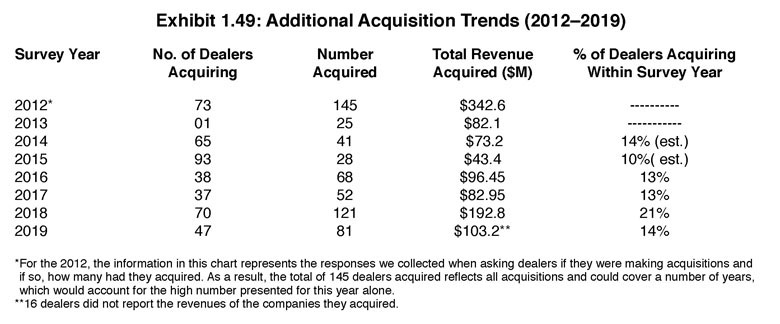

The number of acquisitions reported by respondents in this year’s Survey was surprisingly down from last year. A total of 14% of dealers (47) in our universe of 344 respondents reported acquisitions in this year’s Survey (Exhibit 1.49), with 81 firms acquired. Last year, 70 dealers reported acquiring 121 companies. Apparently, there seems to be a huge disconnect from what is happening in the channel and what is reported in our Survey. One possibility is that many dealers that are making acquisitions are not participating in our Survey. Then, there”™s Visual Edge, one of 2018’s most active acquirers. In 2018, to the best of our knowledge, Visual Edge acquired more than 20 companies. Those numbers are not reflected in our Survey. Neither are the acquisitions that were not reported; many dealers, and even OEMs, acquire but don’t publicize the acquisition. For the sake of the integrity of the Survey, we’re going to focus exclusively on how dealers responded to our questions about acquisitions.

Most acquisitions were of smaller companies, with the average value of the acquired companies coming in at $1.6 million, down from $1.7 million a year ago. Please note that respondents did not report the revenue for 16 of the acquired companies, so $1.6 million reflects the revenues of those 65 acquired companies.

Last year, 66% of Survey respondents reported acquisitions were in their plans for the following year and beyond. This year, that percentage fell to 50% (173 dealers of our universe of 344 Survey respondents). We believe this decline can be attributed to a lack of suitable acquisition targets and competition from well-heeled acquirers. Just as they did in last year’s Survey, Canon dealers were most interested in acquiring (66%), followed by Ricoh (54%), Konica Minolta (50%), Sharp (47%), and Kyocera (46%). Picking up the rear were Toshiba dealers (22%). The “Other” category, comprising HP and Xerox dealers, found 37% (three of eight dealers) considering acquiring. We may see the percentage of Toshiba dealers acquiring or interested in acquiring rise in next year’s Survey, as the company seems to be interested in helping its dealer channel grow through acquisition. That’s something we heard in our visit to Japan a year ago, and it was again underscored this year when we interviewed TABS CEO Scott Maccabe for our July-August issue.

As dealers continue to acquire, the regional footprint we’ve referenced in past Surveys continues to expand for many of the larger dealerships such as ACP, Centric Business Systems, DEX Imaging, Marco, and POA. In some markets, the acquisitions have depleted the landscape of independent dealerships. We can’t help but reference as we did last year the Atlanta market, where only three independents remain by our estimates, and Denver, where ACP faces modest competition from one or two other independents and a few direct branches.

Although the number of dealers acquiring and the number of acquisitions reported in this year’s Survey was down from last year, no way, no how, do we see the acquisition frenzy of the past few years slowing down. At press time, we have reported a total of 48 acquisitions in 2019. We will continue to monitor industry acquisition activity and how these acquisitions are changing the channel. In most instances, it’s subtraction by contraction, even if many of the dealerships that have been acquired by private-equity-backed companies continue to operate mostly as they have in the past.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.