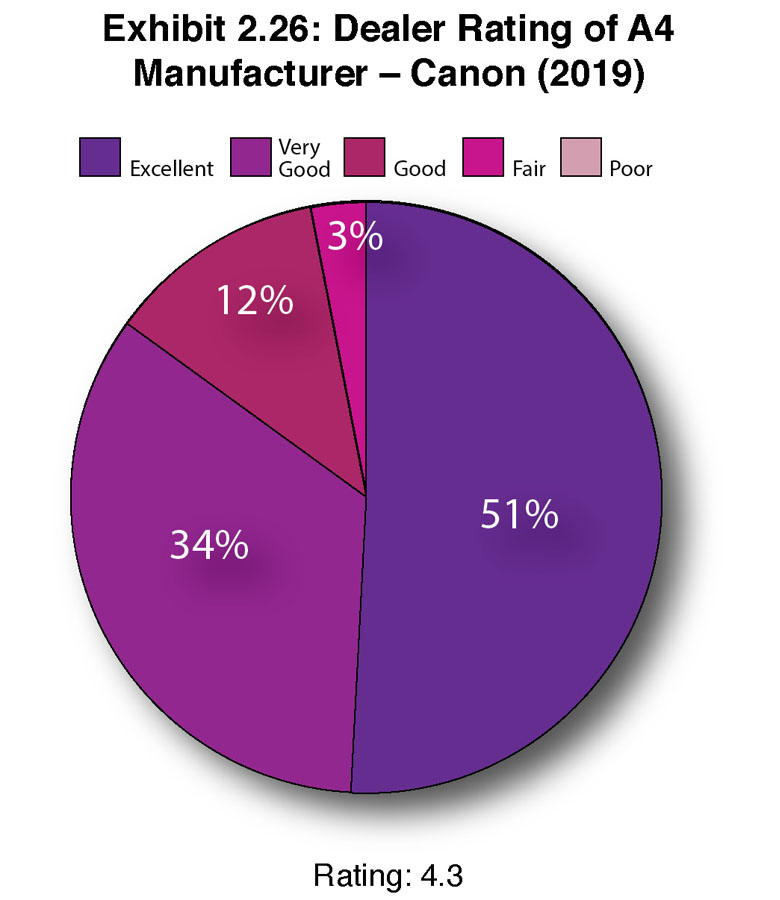

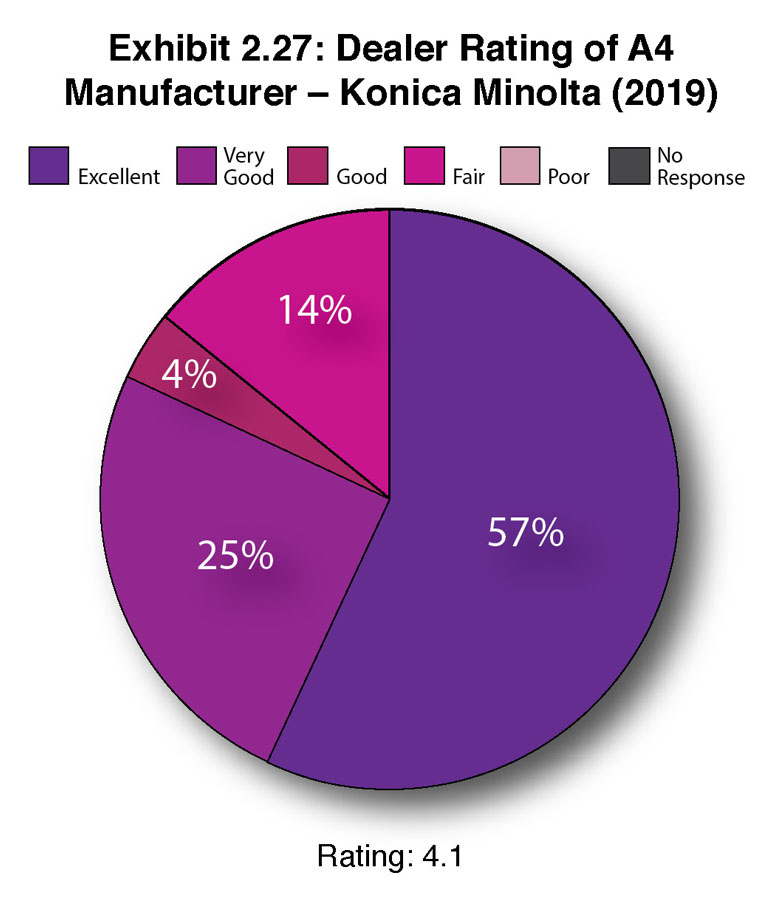

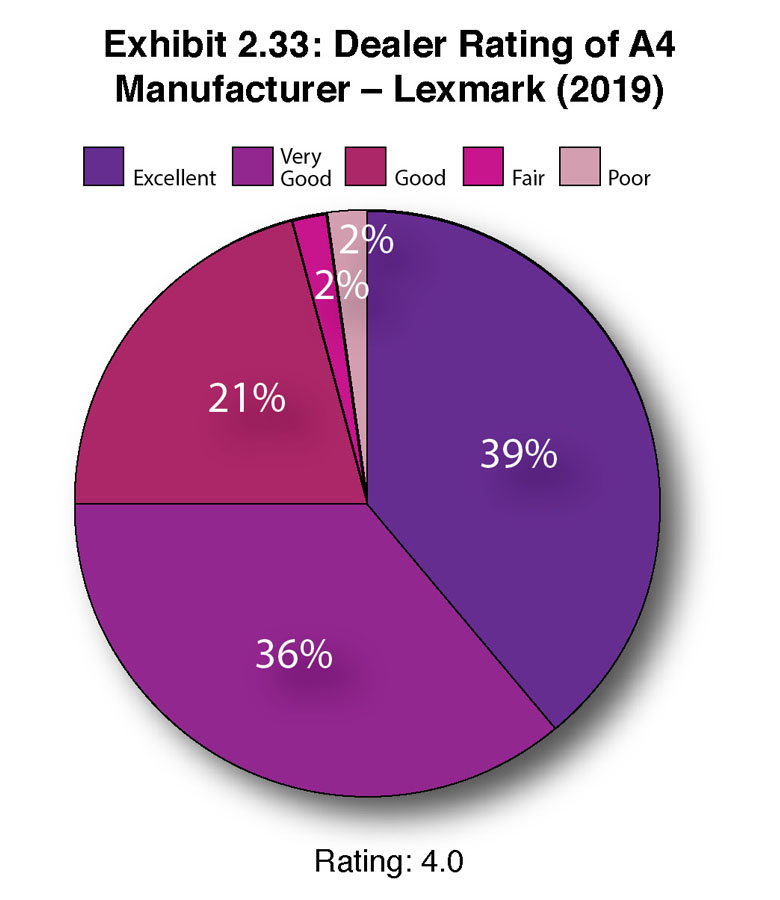

In addition to asking dealers to rate their A3 manufacturers, we asked them to rate their primary A4 manufacturer. With companies such as HP, Lexmark, and others offering A4 devices, dealers have an array of options to choose from beyond the Big Six OEMs. Because not all Big Six OEMs have a strong A4 offering, some dealers have found they need to look beyond their primary A3 OEM to fill their A4 requirements. We heard about that earlier this year when we attended a Brother analyst briefing where a Ricoh dealer who was dissatisfied with Ricoh’s A4 offering shared his reasons for adding the Brother A4 line. After seeing the percentage of dealers who identified one of the Big Six as their primary A4 supplier rise from 67% in 2017 to 75% in 2018, that percentage slipped to 70% this year. This dip reflects the many quality A4 options available to dealers and their fickleness about their primary suppliers from year to year.

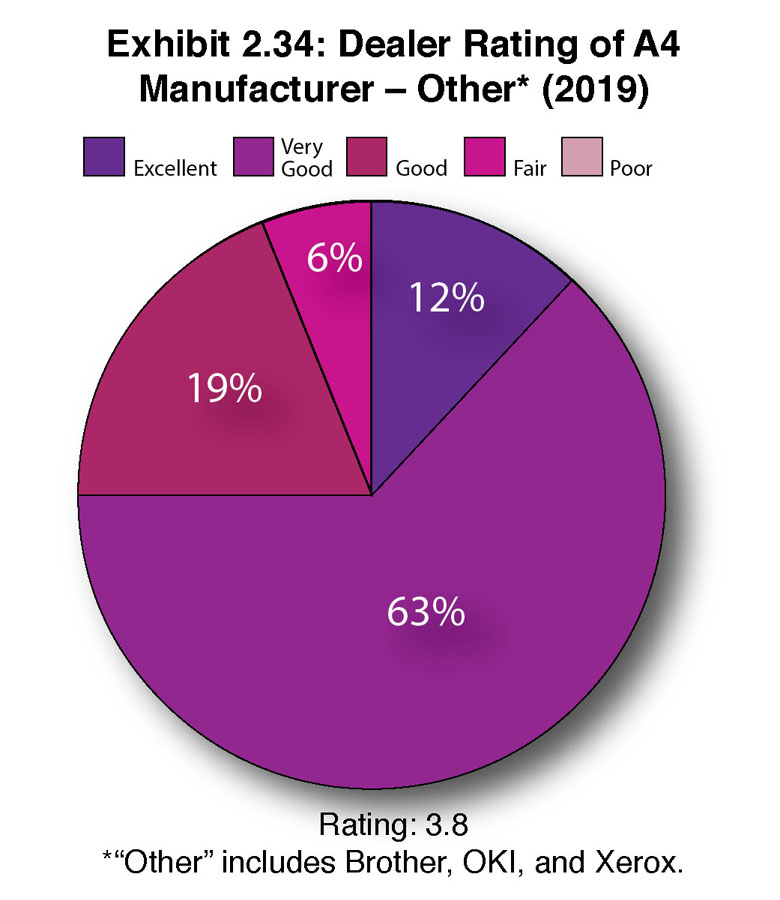

Our ratings of A4 manufacturers include the Big Six, as well as Lexmark and HP. The “Other” category in the ratings includes Brother, OKI, and Xerox. After not being identified as a primary A4 supplier in our 2017 Survey, Brother reemerged last year. Because only 10 dealers in our Survey identified one of those three companies—Brother, OKI, Xerox—as a primary A4 supplier, readers should keep that in mind when viewing the ratings in Exhibit 2.34.

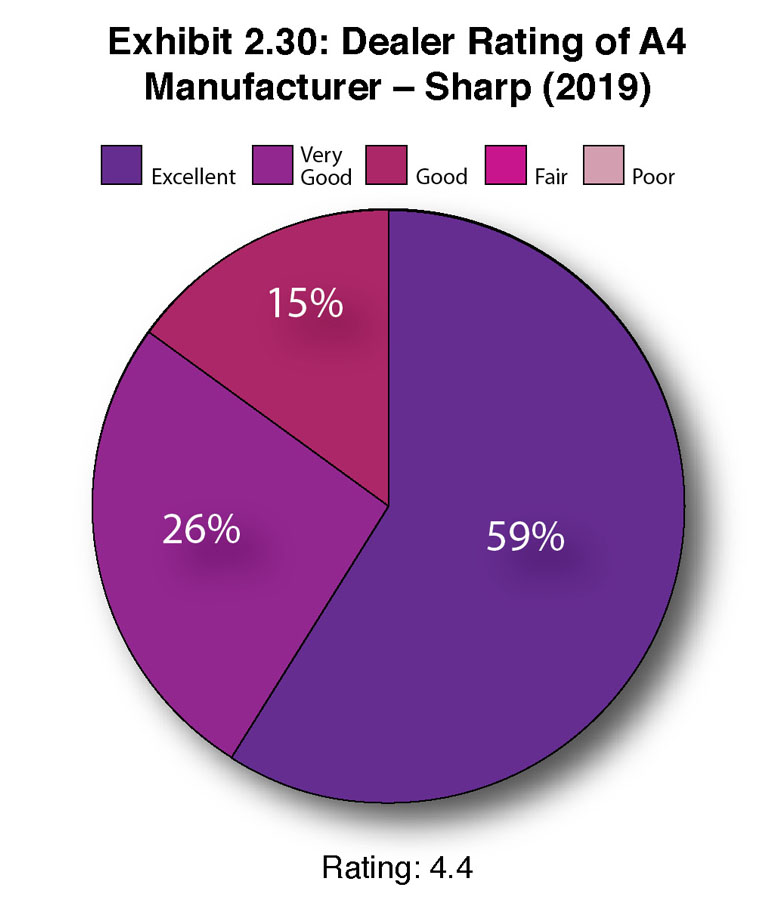

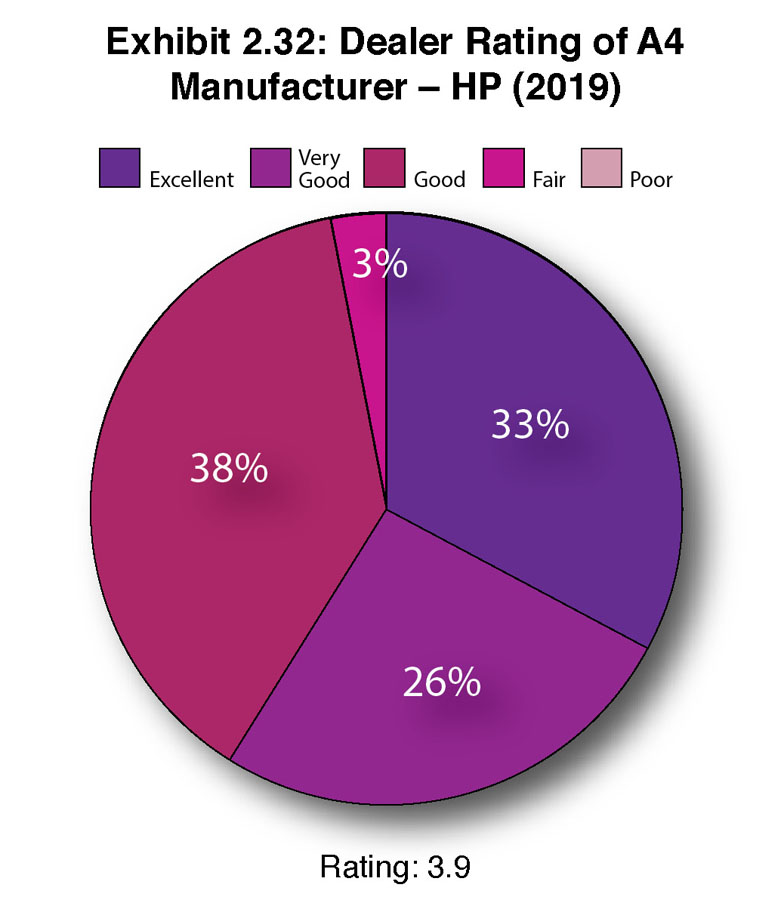

One variation we’ve been noting in our Survey the past few years is how dealers rate their A3 and A4 suppliers. The Big Six don’t typically receive the same kind of grades for A4 as they do for A3 as A3 is still the primary focus for OEM and dealer alike because of the higher margins associated with A3. Admittedly, we were surprised how low some dealers rate their primary A4 MFP manufacturer. That said, there was a slight uptick over the previous year from 3.98 in 2018 to 4.2 this year, still lower than the average A3 rating.

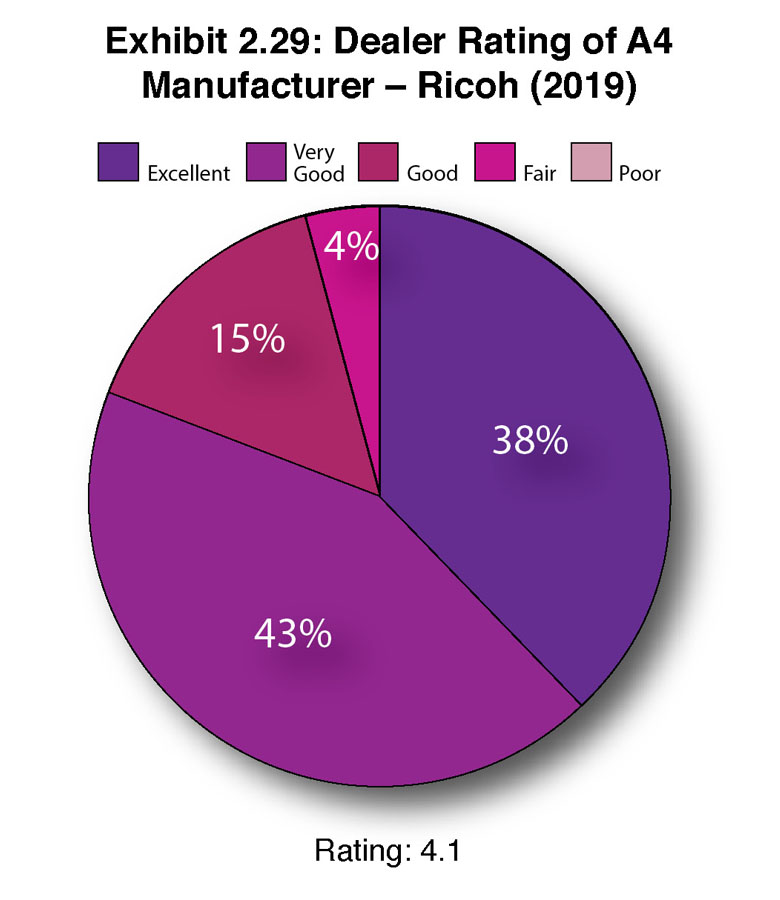

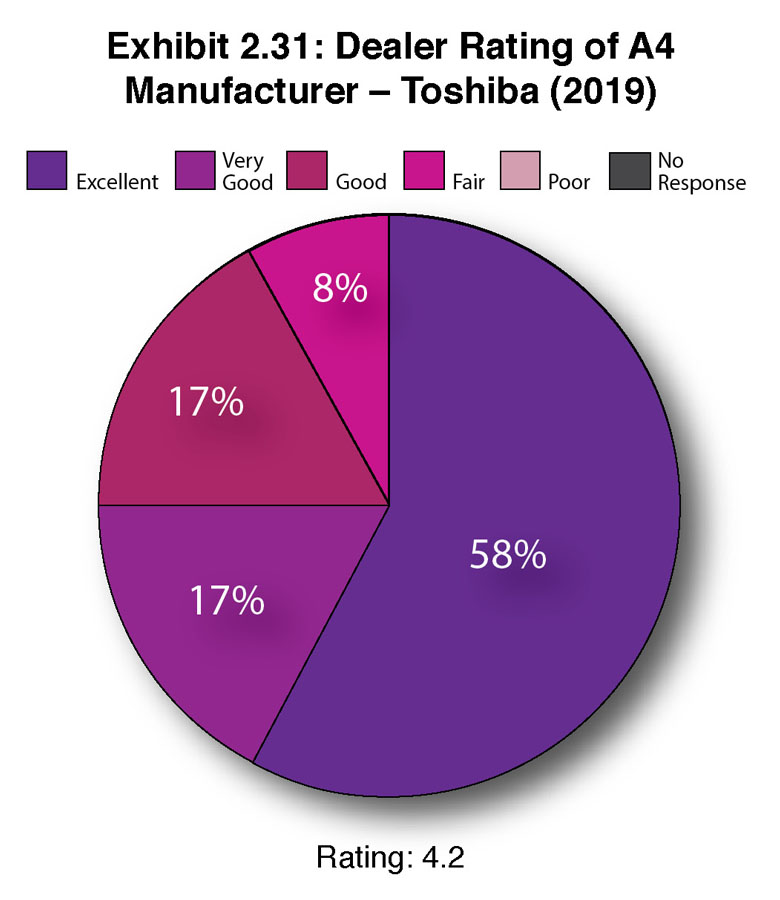

Examining how each vendor performed compared to the previous year, nearly all A4 manufacturers receive higher ratings in this year’s Survey compared to 2018. Some of those increases were modest, but still indicate higher satisfaction with those manufacturers by dealers. Toshiba and the “Other” categories receive identical ratings in this year’s Survey and last year’s.

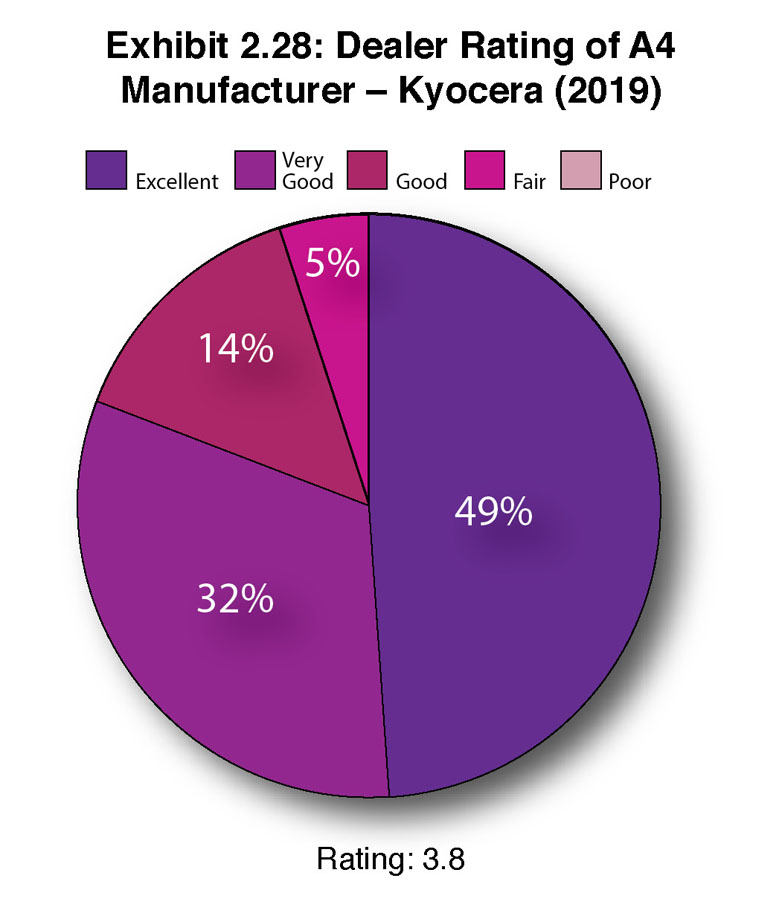

The company that took the biggest hit was Kyocera, which had a 4.4 rating in 2018 and only a 3.8 rating in 2019. The big drop was in the number of dealers who gave Kyocera an “Excellent” rating. Last year, 58% of dealers rated the company “Excellent,” while this year only 49% did. Reading the comments from Kyocera dealers that explain their ratings doesn’t yield many clues as to the decline. None of the concerns had anything to do with the quality of the products. Instead, dealers cited pricing; service from the manufacturer; major account reps who they feel they are competing against, and as a result, are not receiving proper credit for major account sales; difficulty in reaching their Kyocera rep; and concerns about the future of the company. One dealer even noted the company doesn’t understand marketing. In all fairness, those complaints can be leveled against any manufacturer at any time in the relationship. If a dealer is having an issue with a manufacturer while they are filling out our Survey, you can bet that will be reflected.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.