Exhibits 1.6-1.9

Whatever resistance dealers had to A4 in the past (primarily the lower margins compared to A3) seems to have dissipated in the wake of a new reality. That reality is that A4 is good enough for more customers. As they print less, it turns out they don’t need all the bells and whistles associated with A3. But that reality doesn’t mean A3 is dead, nor does it mean that dealers aren’t going to be selling customers an A3 device when an A4 will do. It’s just that a dealer needs an A4 line in order to compete, particularly in MPS. While margins are low, some dealers have told us the aftermarket for A4 can be quite profitable.

Whatever resistance dealers had to A4 in the past (primarily the lower margins compared to A3) seems to have dissipated in the wake of a new reality. That reality is that A4 is good enough for more customers. As they print less, it turns out they don’t need all the bells and whistles associated with A3. But that reality doesn’t mean A3 is dead, nor does it mean that dealers aren’t going to be selling customers an A3 device when an A4 will do. It’s just that a dealer needs an A4 line in order to compete, particularly in MPS. While margins are low, some dealers have told us the aftermarket for A4 can be quite profitable.

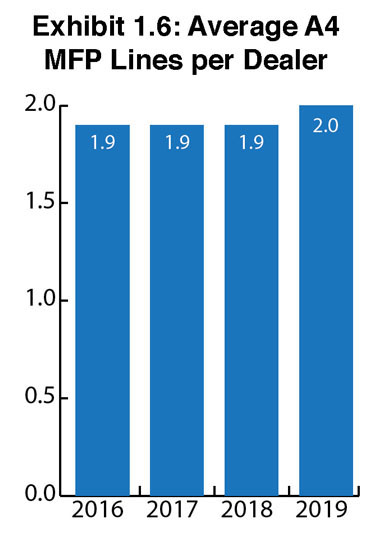

Consistency still rules in our Survey around the number of A4 lines carried per dealer (Exhibit 1.6). Since 2016, we’ve seen that number hover between 1.9 and 2.0, with 2.0 being the average number of A4 lines reported by dealers in this year’s Survey.

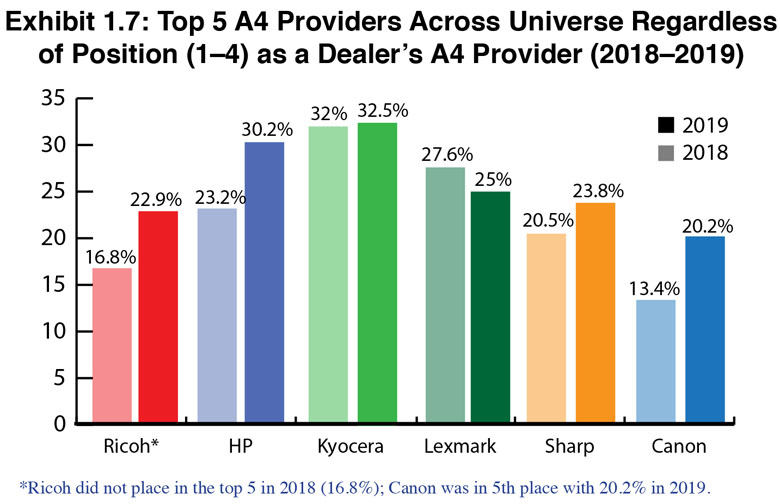

Starting last year, we identified the top five A4 brands regardless of whether the brand was a Big Six manufacturer or a secondary manufacturer, and regardless of its position as a dealer’s A4 provider (Exhibit 1.7). Among the top five, there was only one change from last year with Ricoh entering and Canon exiting. Once again, Kyocera took the top spot with 32.5% of the universe carrying the brand, a percentage nearly identical to last year. HP (30.2%) moved into second place ahead of Lexmark (25%). The fourth and fifth positions, respectively, were held by Sharp at 23.8%, representing a little more than a 3% increase over last year, and Ricoh not far behind at 22.9%.

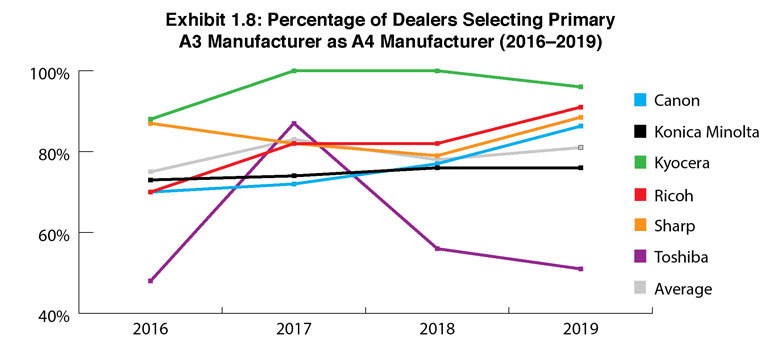

The percentage of dealers selecting their primary A3 manufacturer as an A4 manufacturer was similar to last year. Toshiba continues to see its percentages drop. Last year, we saw Toshiba’s percentage drop from 87% in 2017 to 56% in 2018. This year, that percentage fell to 51%. A lot of this reflects the reality that Toshiba is not considered an A4 manufacturer and that its dealers are likely sourcing some of their A4 products through Brother (24.5%), HP (34%) or Lexmark (49%). Twenty-six percent of Toshiba dealers also sell Kyocera A4. While Toshiba is not considered an A4 manufacturer, that is expected to change, as we learned in a recent conversation with Scott Maccabe who disclosed the company is working on developing its own A4 products. What that will mean to Toshiba’s partners, Brother, HP, and Lexmark remains to be seen.

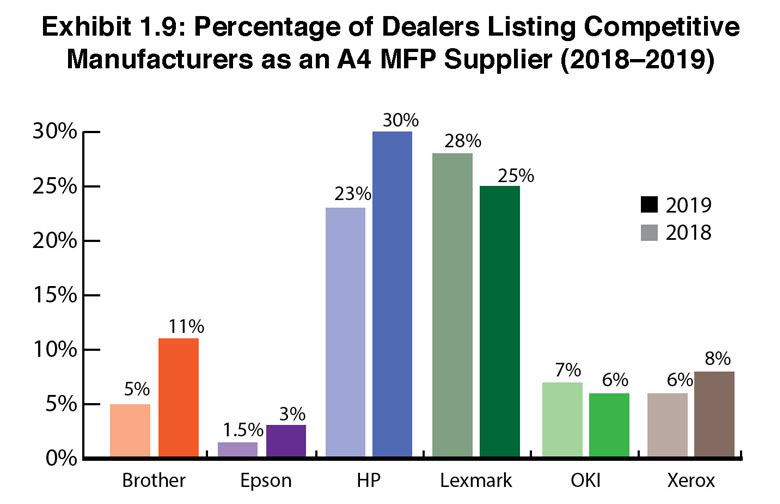

Exhibit 1.9 highlights A4 suppliers not among the Big Six, some of which offer A3 products as well. Pay particular attention to Brother and Epson, both of which doubled their percentage of A4 penetration in the channel this year. Both companies are looking to more firmly embed themselves in the dealer channel, not that Brother hasn’t in the past. We fondly remember those Brother breakfasts at the old NOMDA shows back in the late ’80s and early ’90s. But after fading from view for more than a decade, Brother now has strong initiatives in place to grow its presence in the channel, as does Epson.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.