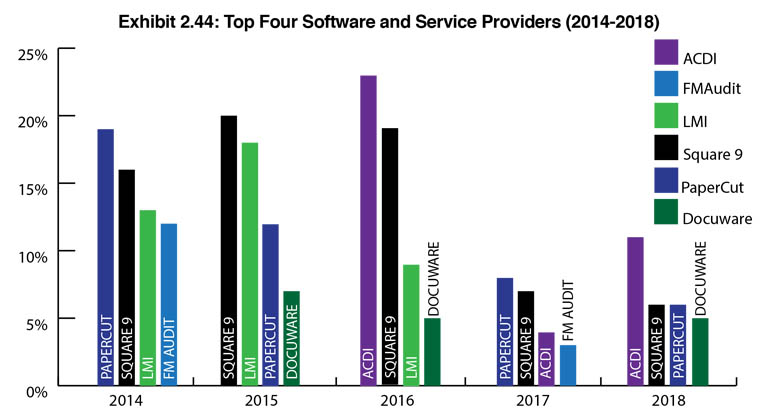

Exhibit 2.44

This is the fifth consecutive year we have asked dealers to identify the companies””excluding the hardware manufacturers and leasing companies””that provide them with the software and support that allows them to compete most effectively.

Software is an extremely competitive category because there are so many players, and the responses from dealers illustrate the many options available. Here, pre- and post-sales support is extremely critical to the dealer, as software has become a key differentiator of many hardware sales.

This year, dealers identified more than 50 different software providers as offering the best products and support to allow them to compete effectively. Some providers only received one vote, but 32 received multiple votes across our Big Six dealer universe. This wealth of software options, including software from their OEMS, and the diversity in the responses underscore the challenge dealers have in navigating the many software options available to them, as noted in the dealers’ greatest concerns section of our Survey in Part I.

Exhibit 2.44 comprises the top four software providers””ACDI, PaperCut, Square 9, and Docuware. The inclusion of Docuware and Square 9 is indicative of the importance of document management solutions. The only software provider in the top four that scored in double digits was ACDI at 11%. The remaining three scored in the single digits, 6% each for PaperCut and Square 9, and 5% for Docuware. These modest percentages shouldn’t be viewed as a negative, but more a reflection of the many software choices dealer have.

If there were any surprises in this section of our Survey it was the poor showing of Hyland Software. Considering Kyocera’s acquisition of DataBank, a provider of business automation solutions, including Hyland Software, we thought that Hyland would have been identified as one of the top software solutions by more than one Kyocera dealer. It may still be too soon to tell just how much traction Hyland Software will have in the Kyocera dealer channel. There was a lot of emphasis on DataBank and Hyland Software during Kyocera’s dealer meeting in April, but that wasn’t reflected in our Survey results. We’ll be watching to see how Kyocera dealers rate Hyland Software in next year’s Survey as Kyocera’s dealers will have had more time to evaluate the software and decide if they should include it among their software offerings.

Looking at some of the other software providers that were identified by multiple dealers in our Survey, print management and document management solutions received most of the votes with print management solutions such as FMAudit, PrintFleet, e-automate, and Print Audit receiving a combined 6% across the Big Six dealer universe. Five percent of respondents identified another document management provider outside Docuware and Square 9, such as Ademero, Drivve, Laserfiche, M Files, MaxxVault, and Y Soft.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.