Exhibits 1.30-1.32

The emergence of MPS has given desktop printers credibility within the dealer channel. Regardless of how dealers define their MPS offerings, printers remain an element of that MPS equation. Even dealers that once disdained printers due to their notoriously low margins have come around thanks to MPS. If dealers are seeking to establish themselves as a full-service organization, or at least give the impression they are one, dealers should be offering an MPS program, which includes supplies and hardware. As our Survey starkly reveals, those printers don’t have to be limited to the HP brand.

The emergence of MPS has given desktop printers credibility within the dealer channel. Regardless of how dealers define their MPS offerings, printers remain an element of that MPS equation. Even dealers that once disdained printers due to their notoriously low margins have come around thanks to MPS. If dealers are seeking to establish themselves as a full-service organization, or at least give the impression they are one, dealers should be offering an MPS program, which includes supplies and hardware. As our Survey starkly reveals, those printers don’t have to be limited to the HP brand.

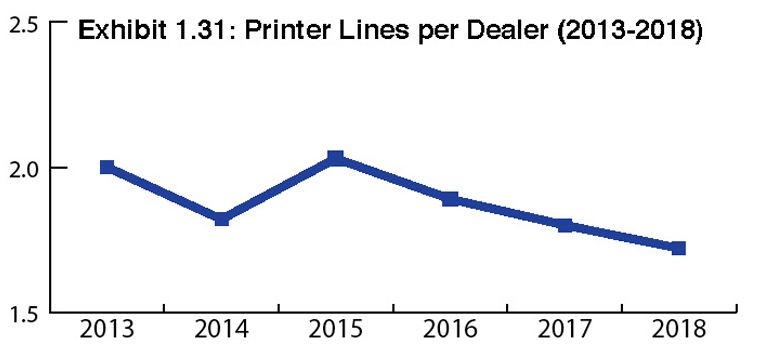

Even with the uptick in the number of Survey respondents this year, we still saw a slight decline in the number of printer lines carried by dealers across the entire universe. This year, there were 581 printer lines listed across our total universe of 338 dealers for an average of 1.72 (Exhibit 1.31), which represent a decline from 1.80 in 2017. If we only included the “Big Six” in the average, we would see a modest increase to 1.74 for this year.

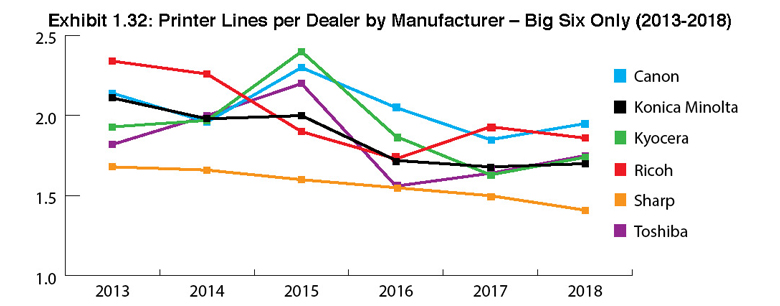

Exhibit 1.32 identifies the average number of printer lines per dealer by manufacturer for the Big Six. The top three slots were held by Canon (1.95), Ricoh (1.86), and Toshiba (1.75). Looking across our Survey results, we checked to see if those figures aligned with where those three companies ranked in the number of their dealers offering MPS. If you turn to Exhibit 1.33 in the following Managed Print Services section of our Survey, you will see that Ricoh (90%), Canon (82%), and Sharp (79%) hold the top three spots in dealer engagement in MPS. Toshiba finished in fifth place at 73%.

When dealers are asked to identify their printer suppliers (Exhibit 1.30), HP took the top slot with 43% of dealers identifying HP as either their first, second, third or fourth printer line. Kyocera, which ranked as the top printer line last year with 32.6% of dealers identifying this manufacturer as a printer supplier, finished with an even stronger result of 38% for 2018. (Please note that the 2017 result was somewhat distorted, as only 22 Kyocera dealers participated in last year’s Survey compared to 58 this year.) Lexmark also ranked pretty well with 29% of its dealers identifying the company as a printer supplier. From what we can surmise, dealers don’t seem to have any concerns about the future of Lexmark after its acquisition in 2017 and the leadership changes that have taken place since then.

Although Brother (7.4%), Epson (1.78%), OKI (6.8%), and Xerox (3.5%) did not finish anywhere near the Top Five among printer brands in Exhibit 1.29, it’s worth noting the percentage of dealers that identified these companies as a supplier. Each of these manufacturers maintain a presence in the channel, despite strong competition from the bigger players, and for dealers that carry those products, they clearly fill a niche, albeit a small one.

In 2017, we observed that some of these secondary brands may be acquisition targets themselves after witnessing the Lexmark and Muratec acquisitions. It’s clear nothing is off the table, but if we were to identify a company that is ripe for acquisition, even though it is not known first and foremost as a printer manufacturer, we’re thinking it could be Xerox. The sentiment is it wouldn’t come as a surprise if Xerox were to be sold in pieces such as Global Imaging, the technology, and the R&D. It could even be possible HP has its sights set on Global. It feels as if it would be a strong possibility, especially in the wake of HP’s big U.K. acquisition made this past summer.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.