As dealers voice concerns, rate partners, and share future perspectives, their comments remain highly objective and mostly positive.

If we had to identify the one thing we appreciate most about the dealers who respond to our Survey, it’s their honesty. That’s especially true when we ask them to share their concerns with us and to rate their vendors and leasing partners. Admittedly, some can be quite harsh with their comments that support their ratings, but by and large, it’s constructive criticism. Overall, most comments remain highly objective and positive.

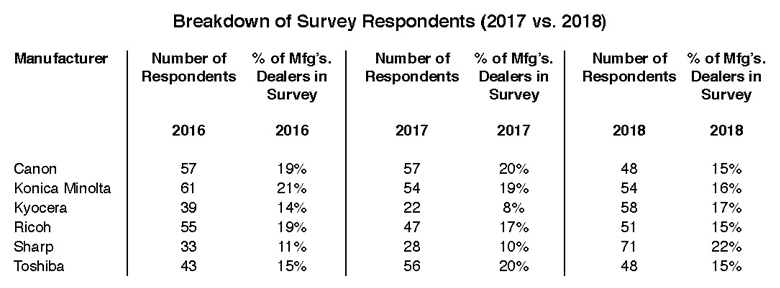

As we noted in Part I of our 33rd Annual Survey, this year’s Survey had the largest number of responses ever with 338, including 330 from dealers representing the Big Six OEMs”” Canon, Konica Minolta Business Solutions, Inc. (Konica), Kyocera Document Solutions America, Inc. (Kyocera), Ricoh America’s Corp. (Ricoh), Sharp Imaging and Information Company of America (Sharp), and Toshiba America Business Solutions, Inc. (Toshiba). Last year, we had 277 responses. This year’s Survey was also much more balanced than last year in terms of the number of respondents from dealers aligned with the Big Six, ranging from 48 to 71. That was a welcome change from last year’s Survey which was somewhat less balanced because of the modest participation by Sharp and Kyocera dealers. The number of Sharp dealers participating this year rocketed from 28 in 2017 to 71 this year, the largest participation of any OEM’s dealers in the history of our Survey. Similarly, the number of Kyocera dealers participating rose from 22 to 58. Both companies made a strong effort to encourage their dealers to participate this year and the proof is in the numbers.

This year, we’re expanding our coverage and data related to dealer’s concerns. We thought it would be more insightful to rank all the concerns of dealers aligned with the Big Six, in addition to our historical coverage of dealers’ primary concerns. What you’ll see in this section are some distinct variations in the overall concerns expressed by each manufacturer’s dealers. Even though their primary concerns tend to be consistent, when viewed in total, the percentages and biggest concerns shift from manufacturer to manufacturer and overall.

Finally, we can’t help but feel as optimistic as our readers are now that we’ve completed the number-crunching and analysis and the results are published. Let the optimism about our industry reign as we present Part II of our annual Survey.

Methodology Revisited

As we observed in Part I of our October 2018 issue, we conducted this year’s Survey online for the fifth consecutive year for easier accessibility and to elicit more responses. This year the Survey yielded 338 responses””61 more than last year””after we deleted duplicates, those with corrupted data, and incomplete submissions. Across the history of the survey, the numbers from dealers representing the Big Six OEMs””Canon, Konica Minolta Business Solutions, Inc. (Konica), Kyocera Document Solutions America, Inc. (Kyocera), Ricoh America’s Corp. (Ricoh), Sharp Imaging and Information Company of America (Sharp), and Toshiba America Business Solutions, Inc. (Toshiba)””tend to vary from year to year. As a result, some years are more balanced than others, with 2016 being one of the most balanced when accounting for OEM population in the history of the survey. Last year’s Survey was not as balanced as we would have liked because of the modest number of responses from Kyocera and Sharp dealers. This year, we exceeded 2016 on balance, and all years in the number of participants representing each of the Big Six, most notably through the increased participation by Kyocera and Sharp dealers. (Please reference the chart in this section that details the universe of our 32nd and 33rd Annual Dealer.)

For the majority of this Survey, we only used the responses from those dealers representing the Big Six, totaling 330. The “other” category comprises HP, Lexmark, and Xerox. When we included responses from the “other” group, we noted their inclusion. Because of dealer feedback, it is important to emphasize that we do not weight our responses. All numbers and percentages reported reflect the actual totals we received. Sometimes, as it did last year with a minimal number of Kyocera and Sharp dealers participating, this does skew the results somewhat, but when that happens, it is noted in our analysis.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.