Exhibits 1.10″“1.14

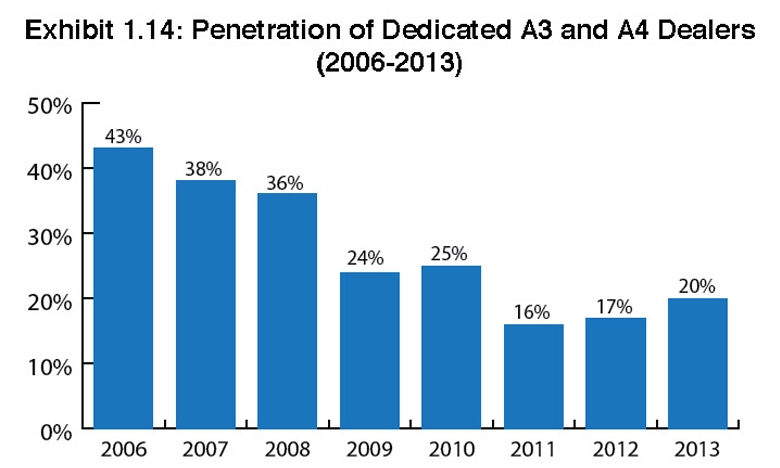

The days of the dealer dedicated to a single A3 manufacturer may be waning, but as we’ve seen during the past three years of the Survey, that figure has been holding somewhat steady at 36% in 2016, 35% in 2017, and 36% in 2018. It wouldn’t be surprising to see those numbers eventually drop to 33% as we move forward, due in large part to ongoing acquisitions, which often add another product line or two to the equation, and a general need by some dealers to bring on other lines to fill gaps in their primary manufacturer’s product lines.

The days of the dealer dedicated to a single A3 manufacturer may be waning, but as we’ve seen during the past three years of the Survey, that figure has been holding somewhat steady at 36% in 2016, 35% in 2017, and 36% in 2018. It wouldn’t be surprising to see those numbers eventually drop to 33% as we move forward, due in large part to ongoing acquisitions, which often add another product line or two to the equation, and a general need by some dealers to bring on other lines to fill gaps in their primary manufacturer’s product lines.

To better identify the manufacturers with the strongest distribution, we examined how they ranked as a dealer’s primary and secondary equipment supplier (Exhibit 1.10). As we pointed out last year, several larger dealers have three or four MFP lines, gained primarily through acquisition. That trend still holds true.

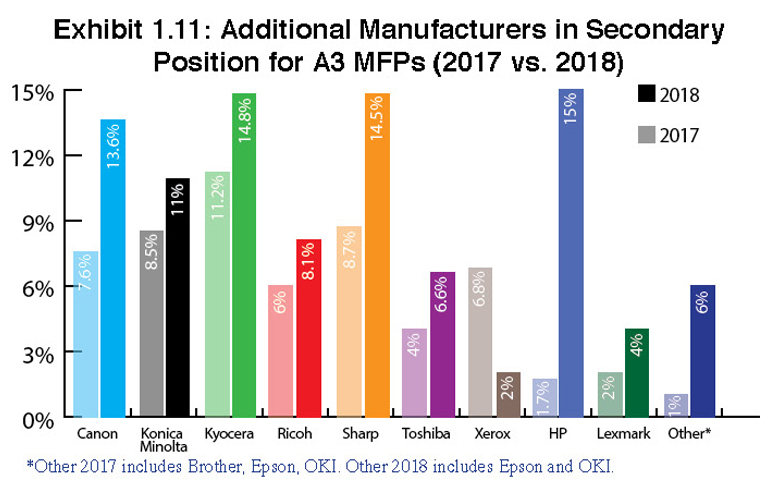

Looking at Exhibit 1.11, Additional Manufacturers in Secondary Position for A3 MFPs, yields some interesting comparisons to last year’s Survey. In last year’s Survey, we noted the possibility of HP increasing its presence in the A3 space as the manufacturer aggressively enters the market. While we did see an uptick across the board for each of the Big Six compared to the previous year, the biggest jump came from HP, going from 1.7% in 2017 to 15% in 2018. It appears HP is gaining some traction in the channel as an A3 provider. The company certainly has been putting on a full-court press, recruiting dealers and getting the word out through an ongoing series of webinars and briefings for press and analysts. What’s also helped HP’s standing as a secondary A3 manufacturer is the Samsung acquisition. Last year, Samsung was noted by 5.38% of our dealer respondents as a secondary supplier, but even combining that percentage with HP’s 1.7% from last year reveals that HP’s goal of becoming a second, third, fourth, or even fifth option for dealers is taking hold in the channel.

In last year’s Survey, 14% (37) dealers identified HP or Samsung as a secondary supplier. This year, we saw 15% (51) dealers do so. With more Survey respondents this year, we’re hesitant to venture too far out on a limb but expect to see HP’s numbers rise in future Surveys as the company continues to grow its distribution in the channel.

Taking a closer look at Xerox, we had high hopes at one time for this manufacturer as a secondary supplier of A3 devices in the channel, but after being cited by 6.8% of our universe in 2017, the company has fallen to 2% in this year’s Survey. It’s a crazy time for Xerox with the on again off again and definitely off again acquisition of Xerox by Fujifilm. Although we believe it’s a distinct possibility that Carl Icahn and his cohorts may eventually dismantle the company, the Xerox brand remains strong. At the same time, in all likelihood, Xerox may not be strong enough to sway dealers into taking it on as a second brand until things have settled down at the company and there’s a better understanding of what that company is going to look like as an office technology provider going forward.

It’s impossible to overlook the impact of the “Big Three” (Canon, Konica Minolta, Ricoh) on the industry and how they are battling it out for mind share and market share in the dealer community. Canon was cited as a secondary line by 19% of Konica Minolta dealers and 24% of Ricoh dealers. Konica Minolta was identified as a secondary line by 27% of Canon dealers and 20% of Ricoh dealers. And Ricoh was noted as a secondary line by 19% of Canon dealers and 15% of Konica Minolta dealers. If you look at the total percentages of the Big Three within each other’s dealer universes in our Survey, Konica Minolta leads with 47%, followed by Canon at 43% and Ricoh at 34%. Dealers that identify one of these Big Three companies as a primary manufacturer and either of the other two as a secondary manufacturer are well equipped to compete across all segments of the printing spectrum, including production print where all three companies have strong product offerings.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.