Exhibits 1.33-1.36

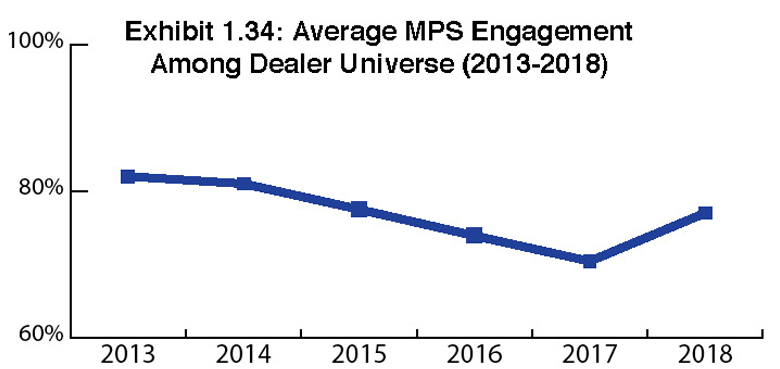

Since we began tracking dealers’ engagement in MPS, it’s been fascinating to watch the evolution of this offering. As much as MPS has become seemingly ubiquitous, the average percentage of dealers offering MPS stands at 77% (Exhibit 1.34). This year’s result was actually up from 70% a year ago, but generally still remains in synch with our 2017 analysis where we surmised that the number of dealers who offer MPS will remain in the 70% to 75% range going forward. Still this year’s percentage continues to represent a decline from 2013 when 82% of dealer respondents reported they offered MPS.

Since we began tracking dealers’ engagement in MPS, it’s been fascinating to watch the evolution of this offering. As much as MPS has become seemingly ubiquitous, the average percentage of dealers offering MPS stands at 77% (Exhibit 1.34). This year’s result was actually up from 70% a year ago, but generally still remains in synch with our 2017 analysis where we surmised that the number of dealers who offer MPS will remain in the 70% to 75% range going forward. Still this year’s percentage continues to represent a decline from 2013 when 82% of dealer respondents reported they offered MPS.

What’s happened since then?

Outside varying definitions of MPS circulating across the dealer community””from a simple CPP program to complete management and tracking of devices with a customer’s location or locations””the modest decline in dealers offering MPS could reflect a wider range of responses from smaller dealers that do not offer MPS. Dealerships with less than $5 million in revenues are often less likely to offer MPS than those with revenues above $5 million, a trend we’ve seen since we started tracking MPS engagement in 2013. While smaller dealers certainly can offer MPS, and some do and do so effectively, especially with enhanced software that makes it easier for smaller dealers to offer MPS, certain smaller dealerships just don’t have the personnel to oversee an MPS program.

Dealer engagement in MPS by manufacturer (Exhibit 1.33) once again reveals Ricoh dealers at the top of the chart with 90% offering MPS, followed by Canon at 82%, and Sharp at 79%. We expected Kyocera dealers to score higher than 71% due to their strong printer line differentiated by low operating costs, which should have positioned Kyocera dealers well within the MPS realm. However, we did note an uptick in smaller Kyocera dealers who do not offer MPS participating in this year’s Survey. Somewhat surprising was Toshiba finishing in fifth place with 73% of their dealers offering MPS. Don’t get us wrong, that’s still a sizable percentage of the Toshiba dealer population, but considering Toshiba was one of the pioneers in the MPS space, one might have thought that message would have resonated more strongly across the entire Toshiba dealer universe.

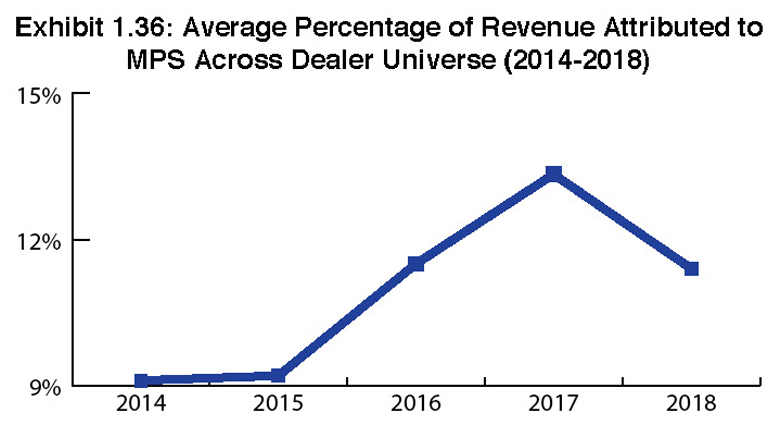

Examining the average revenue dealers bring in from MPS, we saw a decline from approximately 13% in 2017 to 11.4% this year. Overall, we don’t believe this decrease from 2017 to 2018 is an accurate barometer of MPS revenues. Rather, as we’ve noted, the difference is more of a reflection of the higher number of dealers participating in this year’s Survey. According to this year’s results, Ricoh and Canon dealers derive the least amount of revenue from MPS at 9.4% and 9.37%, respectively, while Kyocera dealers ranked No. 1 with 14% of revenues associated with MPS (Exhibit 1.34). Even though fewer Kyocera dealers, on average, offer MPS, those that do are excelling. Sharp dealers (12.7%) and Toshiba dealers (12.6%) are also enjoying double-digit revenues from MPS, as are Konica Minolta dealers (10.4%).

On a positive note, this year, we found fewer dealers that claimed they do not track their MPS revenues even though they offer MPS when compared to 2017’s Survey. With more software and additional tracking tools available to the dealer community, all dealers should be able to track these expenses and revenues today.

Despite those who say, and often rightly so, MPS has been commoditized, there’s no denying that whatever the definition of MPS, it has become and will remain an essential service offering for much of the dealer community. With average revenues from this area hovering above 11%, MPS remains a significant revenue generator.

At the same time, there’s a chance””albeit it a slight one””MPS may be supplanted by other billing methods such as seat-based billing (SBB). However, it doesn’t appear that SBB is gaining as much traction as some of the movers and shakers behind the SBB movement have led us to believe may occur. If anything, we expect to see MPS and MNS, as well as other services, cumulatively capture greater percentages of dealers’ revenue as more dealers shift their focus from hardware to services in response to trends such as declining print volumes within the marketplace. It’s another one of those evolutions the dealer community must contend with, and as we’ve seen in the past, dealers are going to adapt and go where the money is. If it’s not imaging hardware, it’s going to be services and/or something else.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.