Exhibits 1.37-1.39

Providing managed IT or managed network services continues to be the most golden of opportunities for the dealer channel. (We’ll refrain from using “managed services,” as we believe that term can encompass MPS.) A growing number of mid-sized and larger dealers are offering MNS to their customers. As dealers carry more products that connect to the network, it’s a natural extension for them to take ownership of the network too.

Providing managed IT or managed network services continues to be the most golden of opportunities for the dealer channel. (We’ll refrain from using “managed services,” as we believe that term can encompass MPS.) A growing number of mid-sized and larger dealers are offering MNS to their customers. As dealers carry more products that connect to the network, it’s a natural extension for them to take ownership of the network too.

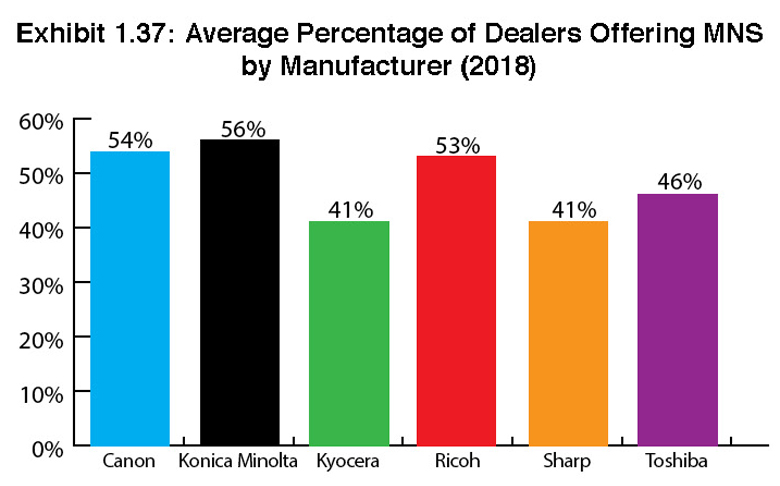

Exhibit 1.37 identifies the average percentage of dealers offering MNS by manufacturer with 50% of dealers responding to our Survey noting that they offer MNS, an increase of 7% from 2017. We believe more dealers are recognizing that owning the network is a viable business opportunity and complements the breadth of their product and services offerings. That 50% is in line with our 2017 prediction that within the next five years, more than 50% of dealers will be offering MNS. Already, we’re seeing an uptick in MNS engagement among dealers representing Konica Minolta (56%) Canon (54%), and Ricoh (53%). We believe it’s highly likely dealers representing those manufacturers will eventually break the 60% mark, as each of these three OEMs are well positioned to help dealers succeed in the MNS business.

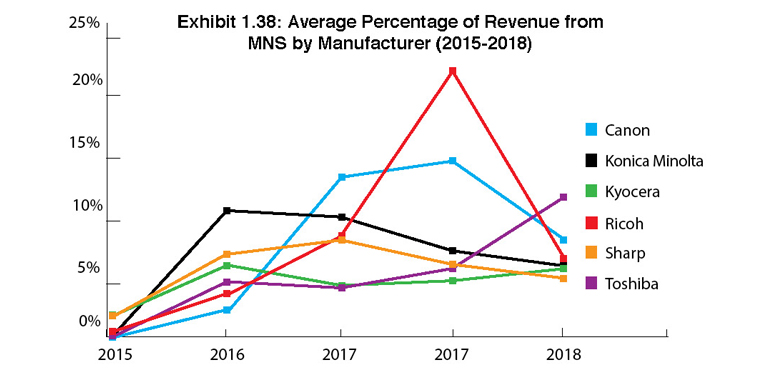

We remain skeptical of the average percentage of revenue from MNS reported by manufacturers (Exhibit 1.38). Those percentages, particularly those from Kyocera, Sharp, and Toshiba dealers, seem to be higher than we think they should be, based on our conversations with dealers and organizations that track MNS revenue based on dealers’ actual financial reports. (Despite this, we do adhere to the honor system with our Survey respondents.) The average revenue percentages reported by Canon, Konica Minolta, and Ricoh dealers look more in line with reality. Please note that 28% (59) of the 155 dealers offering MPS reported revenues of less than 5%, with 27 reporting average revenues derived from MNS of 1% or less.

Anecdotally, during our dealer tours and in conversations at industry events, dealers have told us they should be doing much better than they are in MNS. During our recent dealer tour to Colorado, both dealers we met with acknowledged they have plenty of room to grow their MNS business. Of course, one just started offering MNS two years ago, while the other made a significant acquisition two years ago.

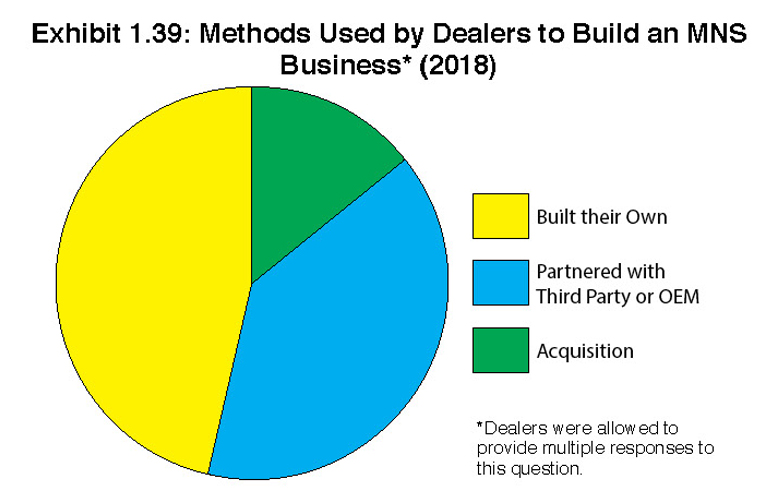

There are different avenues dealers can take to build an IT business, and as our Survey reveals, the least popular way to do so is through acquisition, with only 17% of respondents taking this route (Exhibit 1.39). (Please note some dealers identified multiple strategies for building their MNS business, so the cumulative percentages do not equal 100%.) Even though we’re seeing some of the venture capitalist firms acquiring managed IT companies, as well as some larger dealers, the challenge has been integrating two disparate cultures””a sales-driven, commodity-based copier culture with that of a looser, IT-oriented culture. What sometimes happens is dealers aren’t so much acquiring a base of business as they are the talent to provide MNS. If they can’t hang onto that talent, there’s not a lot of value in that acquisition. That’s likely why 55% of dealers prefer to build their own MNS business or partner (47%) with one of their manufacturers or a third party.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.