Exhibits 2.36″“2.43

Diversity, as well as consistency, continues to rule among the Big Six independent dealer community in the number of leasing partners they are aligned with. For the second consecutive year, the average number of leasing partners stood at 2.6. With dealers being able to identify up to four leasing partners, a total of 24 different leasing options were identified by our respondents, including their own internal leasing arms and leasing from their OEMs, as well as a few leasing companies we are not familiar with, in addition to the usual suspects.

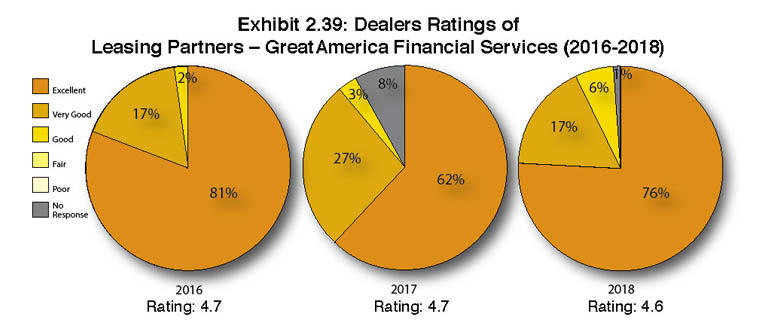

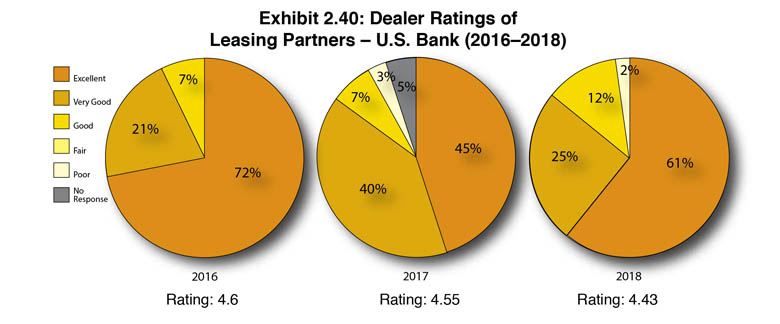

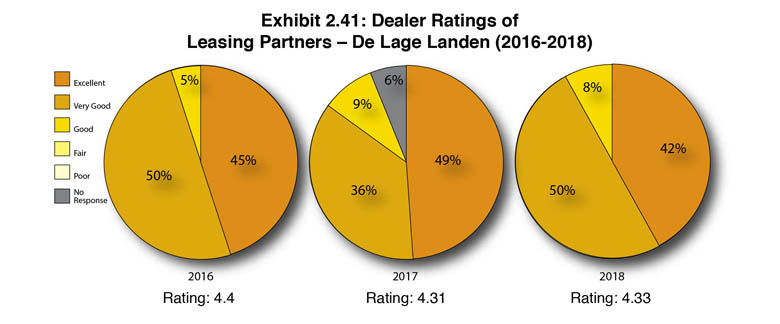

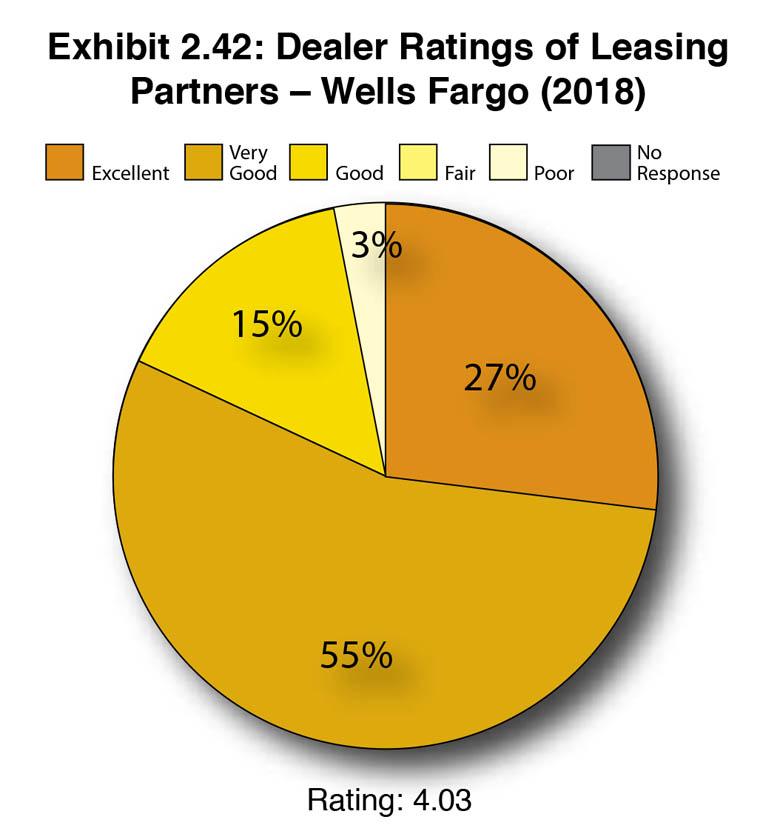

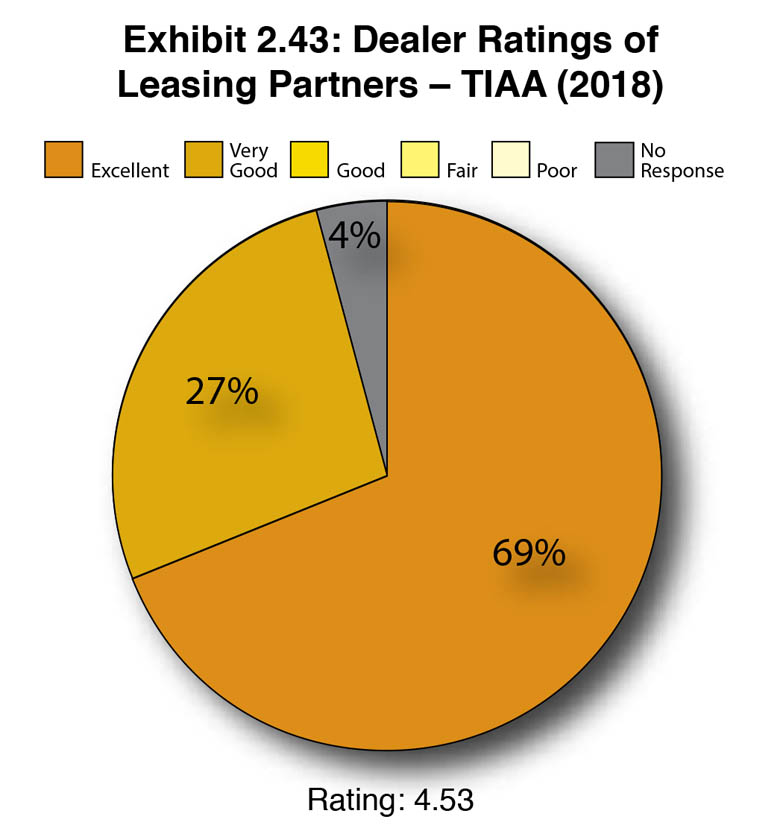

When tabulating dealers’ ratings of their leasing partners, we only include those companies that have been identified by 25 or more dealers as their primary leasing partner. Last year, only three leasing companies made the cut””GreatAmerica Financial Services Corp., De Lage Landen, and U.S. Bank. This year, with a greater number of Survey responses, five leasing companies received 25 or more responses, including GreatAmerica Financial Services Corp., De Lage Landen, TIAA (formerly EverBank), U.S. Bank, and Wells Fargo.

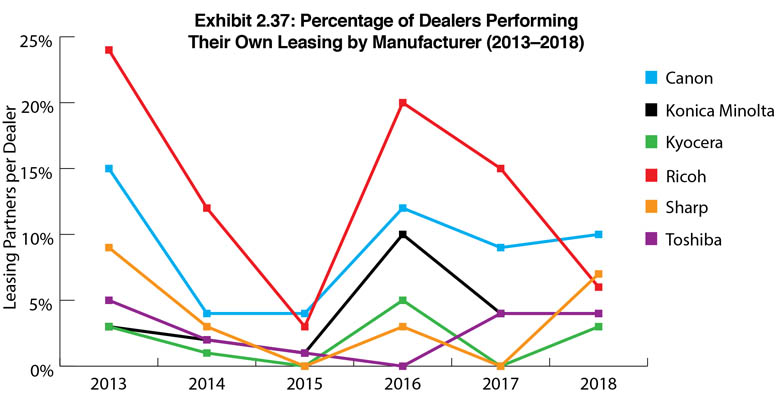

The percentage of dealers handling their own leasing remains low at 5.66%, albeit that’s a slight uptick over 2017 when 5.33% noted they offered an internal leasing program. In 2015, 10% of respondents had an internal leasing program, while that number slipped to 8% in 2016. As we noted last year, we believe this downward trend is representative of a more solid economy, as the economic downturn of 2009 forced dealers to get creative in their financing and an offshoot of that creativity resulted in dealers handling their leasing needs internally as it became more difficult to get financing in the leasing marketplace.

The decline can also be attributed to the fact that the rates available from leasing companies and programs from the manufacturers are still low and dealers can add points to the rate and be close to, if not more profitable than, maintaining their own portfolio without having to deal with the administrative challenges of managing a portfolio. Increased auditing by state governments has also made administering one’s own leasing program more challenging with the complications of managing property taxes for various jurisdictions. Many dealers don’t have the necessary systems in place to do this in a compliant manner. Some dealers have also sold their internal leasing portfolio to pay off the debt of a previous owner after an acquisition or in a succession plan situation. Whatever the reason, we expect to see the percentage of dealers handling their own leasing continue to shrink as the economy remains solid and the number of external leasing options remain at their current levels.

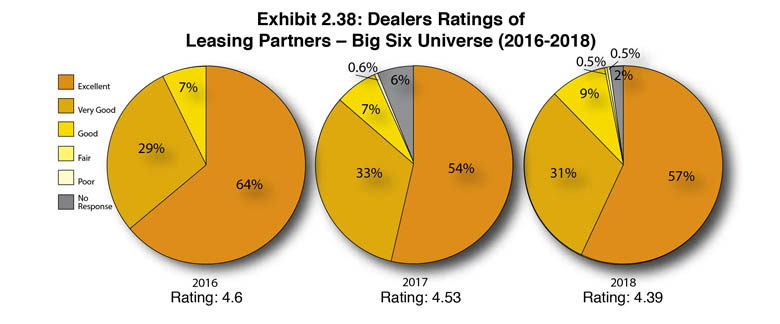

As we have done in our past Surveys, we asked participating dealers to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” and “Poor.” Examining how the Big Six dealer universe ranked their leasing partners in our current Survey, 57% were ranked as “Excellent,” a 3% increase over 2017. With a five-point rating system (with 5.0 being the highest rating), the five leasing companies that were identified by 25 or more dealers as their primary leasing partners, all received scores above 4.00, averaging 4.39, somewhat under last year’s average of 4.50.

Across the Big Six dealer universe, dealers are generally satisfied with their leasing partners, which can be attributed to favorable interest rates and the availability of a growing number of programs for services such as MPS and MNS, as well as emerging technology segments such as production print and digital signage, for example. When it comes to keeping their dealer partners satisfied, we remain impressed with the creativity of the leasing companies to roll with the flow and uncover new ways for meeting a dealer’s financial needs.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.