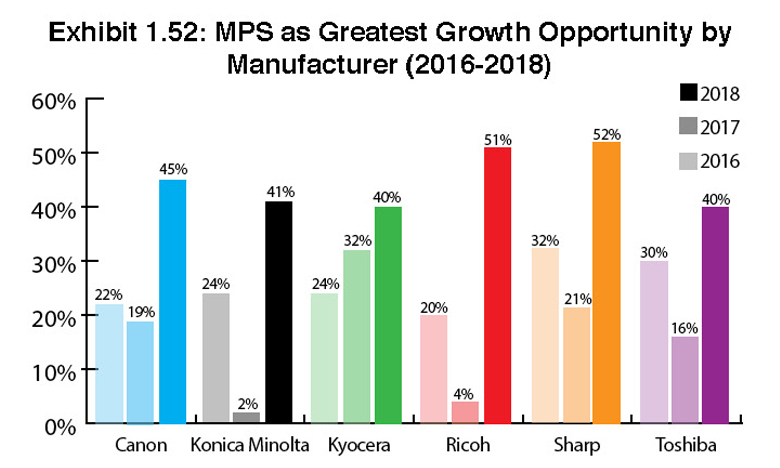

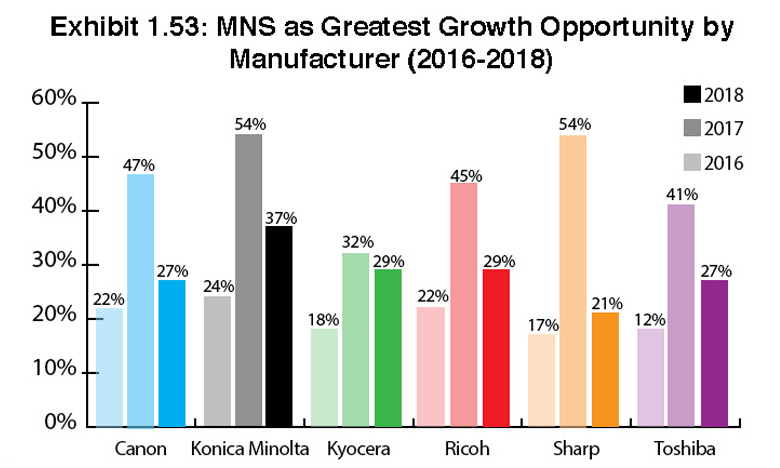

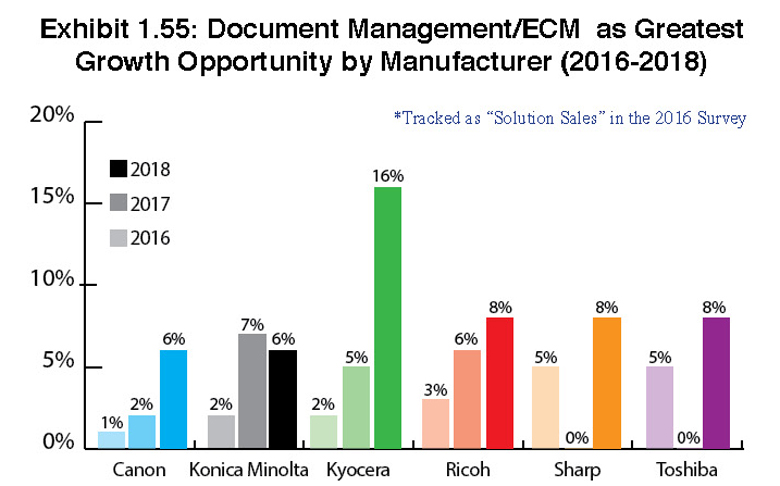

Exhibits 1.52″“1.56

Even before we started asking dealers to identify their greatest opportunities for growth, the dealer channel has been constantly on the lookout for the next big thing to sell and further grow their businesses. Since 2015, we’ve been asking dealers this question, allowing them to provide multiple responses to better reflect their visions for growth.

We asked dealers to identify up to four growth opportunities among the following selections: digital signage, document management/ECM, MPS, MNS, production print/wide format/industrial print, security/cybersecurity, and other.

Across the universe (Exhibit 1.56), the five most identified growth opportunities were MPS, MNS, production print, document management/ECM, and security/cybersecurity. What this tells us is that dealers are looking to offset the decline in clicks with services and solutions, and three of these four opportunities””most notably, MNS, document management/ECM, and security/cybersecurity””offer viable alternatives or supplements to “click” revenue.

Looking at the cumulative universe of growth opportunities and focusing exclusively on the dealers from the Big Six manufacturers, we witnessed some notable changes compared to last year when we asked dealers to identify their greatest growth opportunities. Frankly speaking, some respondents may have misunderstood the question and listed all the areas where they felt they had an opportunity to grow in no particular order. However, for the purposes of this Survey, the first item listed by each dealer is what we identified as the greatest growth opportunity for each respondent.

Compared to previous years, MPS finished significantly stronger in 2018 than in previous years as a dealer’s top growth opportunity (Exhibit 1.52). MNS declined across the board as a leading growth opportunity (Exhibit 1.53). Meanwhile, results were uneven for production print as the greatest growth opportunity with Canon, Konica Minolta, and Ricoh dealers decreasing in interest, while interest among Kyocera, Sharp and Toshiba dealers increased. Particularly notable increases were among Sharp dealers (4% in 2018 versus 0% in 2017) and Kyocera (9% in 2018 versus 4% in 2017), the latter is likely the result of this year’s announcement of Kyocera’s first high-speed inkjet production machine.

We surmise the strong showing of MPS in this year’s Survey can be attributed to dealers concluding that if print is on the decline, there’s still an opportunity for them to manage what prints are being made across an organization. For dealers who subscribe to the rip-and-replace school of MPS, one must believe they consider MPS a door-opener to their rip-and-replace strategy, declining print volumes or not.

Last year, much to our surprise, we saw fewer dealers from every manufacturer identifying production print as their greatest growth opportunity (Exhibit 1.54). It’s common knowledge where The Cannata Report stands on production and industrial print, and if it isn’t, we must emphasize we believe production and industrial print represents two of the strongest opportunities for the dealer community in an era where traditional office print is on the decline. While we were visiting with executives Ricoh in Japan, they presented a statistic that only 10% of commercial print establishments are digital. With that small percentage, whether it’s with production or industrial print devices, opportunities abound to convert those organizations to digital.

On the document management/ECM front, those numbers were also down this year as well (Exhibit 1.55), while only 2% of dealers (8 of 338) identified security/cybersecurity, new among the greatest growth opportunities for dealers to choose from as their greatest growth opportunity. We believe security and cybersecurity also represent a promising opportunity and anticipate this area will garner higher interest in future Surveys.

This year, fewer dealers also identified “other” as a top growth opportunity (1%, or 4 of 338). While we have chosen not to include a separate chart for the “Other” category this year, due to the limited number of responses, there were some solid nuggets of information that we’d like to highlight from these results. Among the dealers who cited “other,” regardless of positioning, they cited 3D printing, business process optimization, environmental services, inkjet technology, physical security, acquisitions, rentals, water service, mailing equipment, technology as a service, interactive whiteboards, software, cloud management, and IT projects. Reviewing the above list, we would list some of those items under MNS.

A total of four dealers identified 3D printing as a growth opportunity. While a handful of dealers have enjoyed success in the space, others discovered it was a more difficult sell than anticipated and the aftermarket revenue wasn’t as profitable compared to traditional imaging devices. As one dealer told me recently, a 3D printer was a $150,000 losing proposition for his dealership and after not achieving any traction selling that equipment, they ended up donating it to a local college. Anecdotally, my partner works for an engineering firm that has a 3D printer. However, it’s rarely used, which means the dealer who sold that piece of equipment to her engineering firm is not selling much in the way of supplies.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.