Exhibits 1.40″“1.45

If service is core to a dealership’s business, then there is great value in examining the makeup of a dealership’s technical operations with an emphasis on break-fix techs and technical specialists for MPS and MNS.

If service is core to a dealership’s business, then there is great value in examining the makeup of a dealership’s technical operations with an emphasis on break-fix techs and technical specialists for MPS and MNS.

We determined the number of service technicians per dealer by asking how many break-fix technicians they employed and how many “other” technicians are on staff to service MPS and MNS clients.

Over the past few years of conducting this Survey, what we’ve discovered is that with the emergence of MPS and MNS, and changing job requirements, it has become challenging to identify a long-term employment trend for technical personnel.

Consider how the industry has changed since 1985, the first year of our Survey. Back then, dealers employed techs with a ratio of 1 to 40, where one tech was responsible for servicing 40 copiers in the field. In those days, analog copiers were much less reliable than the digital copiers of today, which resulted in many more service calls.

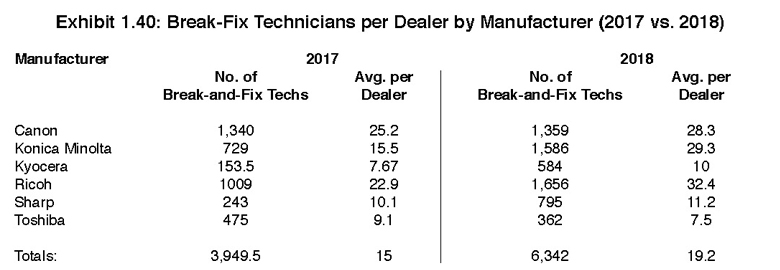

With reliability less of an issue today, even in connected environments, during the past few Surveys we saw a decline in the number of traditional break-fix technicians employed by dealerships. This year we were initially surprised to see the number of break-fix technicians employed by dealers representing a majority of manufacturers among the Big Six (Exhibit 1.40) trend upwards. We attribute this increase to dealers not separating traditional break-fix technicians from MNS and MPS techs. With some of the larger dealers with revenues exceeding $100 million, we believe the increase in the number of service techs employed could also be tied to acquisitions and overall growth in their businesses.

As noted in Exhibit 1.40, the biggest increases in the number of break-fix technicians employed compared to last year were Konica Minolta, Kyocera, Ricoh, and Sharp.

Next year, we will revise this portion of the Survey to better reflect dealers that don’t separate their traditional break-fix technicians from MNS and MPS techs.

Looking at Exhibit 1.41, we saw an overall increase in the number of technicians employed to support MNS and MPS, even as the percentage of dealers employing these techs in 2018 (73.66%) remained similar to 2017 (73.52%). The average number per dealer jumped from 4.3 in 2017 to 7.4 this year. We suspect much of the technical support increases are due to techs with IT certifications who are responsible for handling more IT-related issues rather than MPS-related issues.

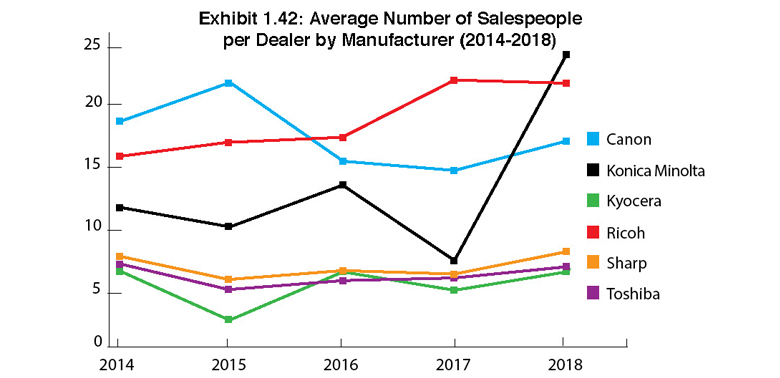

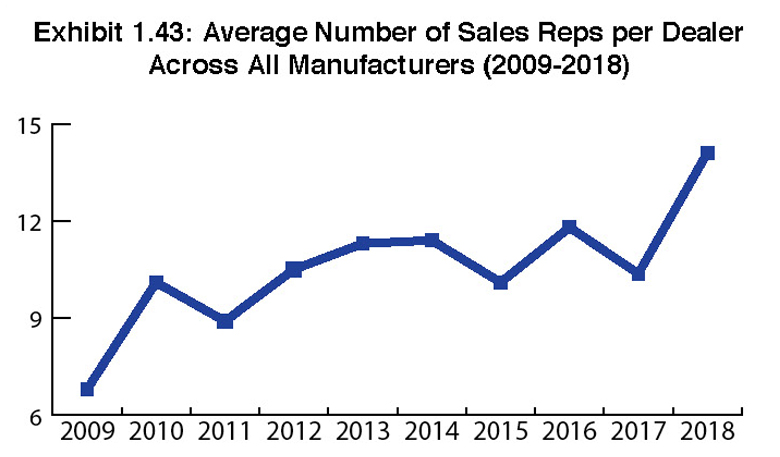

Moving onto the sales side of dealerships, Exhibit 1.43 traces the historical average number of sales reps per dealer across all manufacturers. We began showing data in 2009, a tough time for the industry, which was in the throes of the economic downturn, one that took the industry a few years from which to rebound. We saw a sharp spike in the average number of sales reps from 2009 to 2010, but then, there were more declines and spikes in subsequent years, with a significant spike from 10.37 in 2017 to 14.1 in 2018. We attribute this spike to more significant number of larger dealers that reported sales teams of well over 100 sales reps. Sales is arguably the most volatile position in a dealership with retention being particularly difficult. Admittedly, that’s the nature of any sales position. Reps are required to deliver results, or they’re gone. Sales reps also often leave out of frustration because it’s a tough, grueling job. Given our deep relationships with dealers, we understand their expectations and know how demanding that sales role is. It’s not for everyone and even with recruitment firms that promise to weed out those candidates that aren’t up to meeting the challenges, there’s still nothing like trial by fire to determine who has the right stuff to make it in sales.

Earlier this year, we visited Pacific Office Automation, took a tour of their offices, including their sales bullpens, and attended their annual sales meeting. What stood out for us was the number of young sales reps employed by the company, some of whom have been tremendously successful. But we weren’t wearing blinders either and realize some of those POA sales reps are not going to cut it””it’s the nature of the job and the business.

In 2016, we began examining staff employed by dealerships to provide sales support for MPS and for MNS (Exhibits 1.44 and 1.45). We continue to see a decline in the number of dealers employing specialists to assist in selling MPS from 1.26 in 2017 to 1.13 in 2018. As MPS has matured and become more commoditized, virtually anyone on a dealer’s sales force can sell it, and the need for a sales specialist in MPS is no longer necessary.

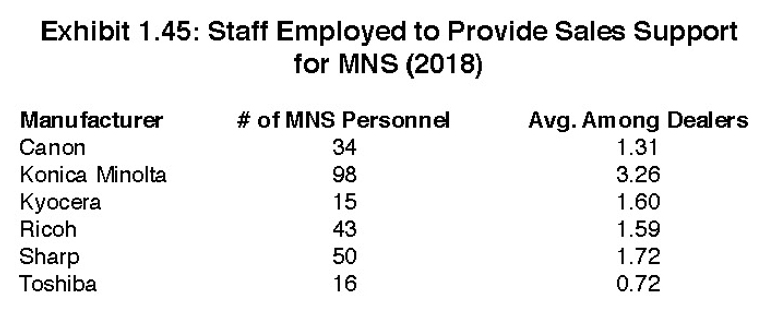

MNS should be another story as it is a more complicated sale, and not one the average down-the-street sales rep is equipped to sell on his own. However, results across dealers of our Big Six manufacturers vary when it comes to employing staff to provide sales support for MNS. When compared to the results from last year, the 2018 tallies for Konica Minolta and Sharp were significantly up, while they dipped for Ricoh and Toshiba and in between for Canon and Kyocera. Yet, when we looked at the average among dealers employing MNS sales support staff, it was 1.70 for 2018, not all that different from last year’s average of 1.80.

MNS remains a volatile service offering. Since dealers first began offering this service to their customers, we’ve seen many that have tried, failed, and/or abandoned it altogether, while others have started, stopped, and started up again. The presence of third parties to assist dealers with their MNS offerings, including GreatAmerica’s Collabrance, Continuum, and Konica Minolta’s All Covered, has helped dealers overcome some of the challenges associated with entering the MNS business or enhancing what they may have started on their own. However, as some dealers have discovered, these third-party organizations aren’t always the panacea for a successful MNS offering, or they may not always be a good fit for some dealerships’ business models as they look to gain a foothold in MNS.

With dealers looking to offset erosion in the channel as print volumes spiral downward, MNS remains one of those business segments with high growth opportunity. MNS remains complementary to what a dealer is already providing their customers. The challenge is how to do it and do it right. Over time, we contend the dealer of the future will live by the mantra of “own the network, own the customer,” especially as they add more IT-related products and services to the mix.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.