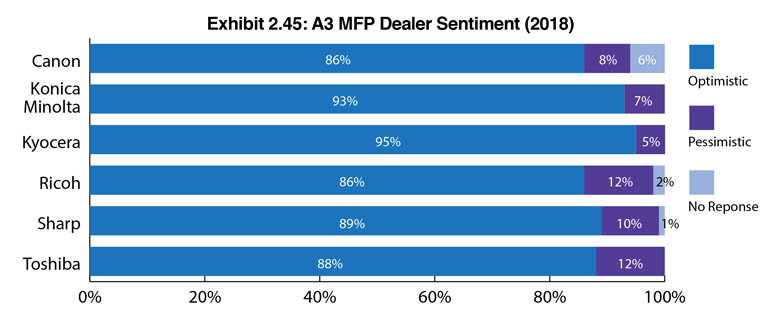

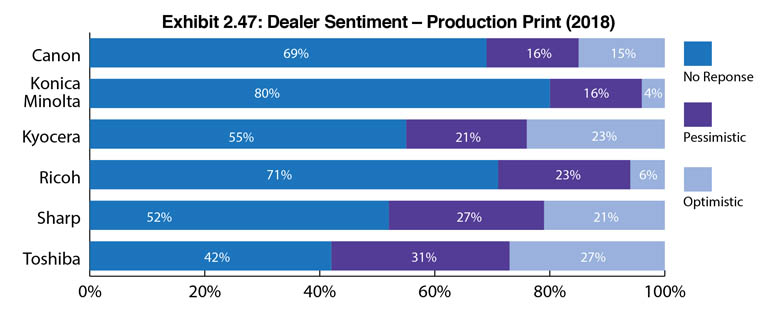

Exhibits 2.45-2.47

As we did last year for the first time, we continue to gauge dealer optimism and pessimism in three areas””A3, A4, and production print. Not every dealer offered an opinion, and for accuracy, we include “none” responses in our percentage calculations. The number of “none” responses are modest for A3 and A4, but somewhat higher for production print, primarily because we suspect most of the dealers that did not provide a response probably aren’t selling production print devices.

For Big Six dealers whose core business is with A3 MFPs, 89% are optimistic even as clicks trend downward and pressure is on to diversify beyond A3. That’s a 10% swing compared to last year when 79% were optimistic. This year, 9% said they were pessimistic, while 2% offered no response. The most optimistic dealers in the A3 group are Kyocera and Konica Minolta dealers at 95% and 93%, respectively. The least optimistic dealers in this year’s Survey are Canon dealers (85%). Still, that’s a 10% improvement over last year when 75% of Canon dealers said they were optimistic.

Why the greater sense of optimism in 2018 compared to 2017? In Canon’s case, it may be that the company has had more dealer-oriented events, which have provided dealers with a clearer view of the company’s future plans. There was also a significant increase in optimism among Sharp dealers, 89% of whom are optimistic compared to just 71% last year. There was a lot of uncertainty about Sharp’s future in 2016 and early 2017, but those concerns seem to have been alleviated now that the Foxconn acquisition has settled in, and the company is back on track and continues to perform well financially.

On the A4 front, Kyocera dealers remain the most optimistic at 96%, a modest bump from 95% last year. When it comes to A4, Kyocera has a strong track record of excellence, and our Survey results confirm that, at least when looking at Kyocera dealers’ degrees of optimism.

Looking at Sharp, something clearly happened with these dealers’ levels of optimism between our 2017 and 2018 Surveys. In 2017, only 68% were optimistic compared to 94% this year. We’re at a loss to explain this huge fluctuation in A4, although based on our trip to Japan last spring, there’s a wealth of A4 products in the pipeline.

The least optimistic dealers in the A4 space are Konica Minolta dealers at 78%. Here too, we are not sure why, though Konica Minolta dealers are more optimistic than last year about A4 when only 70% said they were optimistic.

Toshiba dealers at 83% gives us pause, even though those who are optimistic are on a par with last year when 82% said they were optimistic. Toshiba dealer’s A4 needs are primarily being met by Lexmark, while some Toshiba dealers, mostly smaller ones we surmise, will now have access to Brother A4 devices.

Overall, 87% of Big Six dealers are optimistic from an A4 perspective, 10% pessimistic, and 3% did not respond.

When we asked dealers to identify how optimistic they were about production print, the percentage of optimism wasn’t as high as in A3 and A4. Here, the average percentage of optimism among the Big Six was 61%, with 23% saying they were pessimistic and 16% that did not respond. On a bright note, the level of optimism for production print rose from last year’s 57%. In 2017, 24% of dealers said they were pessimistic. We’re not surprised by these percentages, particularly since production print is not for everyone, and even for those that decide to pursue it, this segment can sometimes be challenging and require dedicated resources.

Examining how the percentage of optimism in production print broke out among the Big Six, those dealers aligned with the three biggest players in the production space, Canon, Konica Minolta, and Ricoh, were the most optimistic at 69%, 80%, and 71%, respectively. With a production print device on the way, Kyocera dealers are more optimistic this year (55%) compared to 2017, when only 36% were optimistic. The least optimistic dealers in the production space are Toshiba dealers (42%), an 8% decline from 2017.

Cumulatively, looking at the degrees of optimism in A3, A4, and production, the vast majority of dealers remain optimistic about the product lines they are selling, which is a positive indicator for the future of the imaging industry, even as new technologies are evolving it in new and exciting ways beyond where it is today.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.