Exhibits 1.15″“1.17

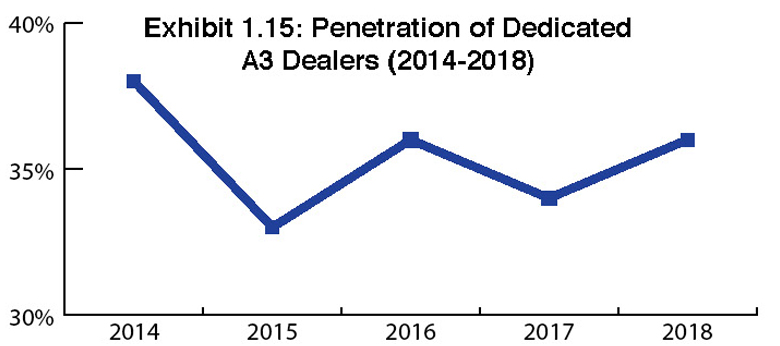

This year, we saw a modest increase in the number of dedicated dealers compared with 2017, which we attribute to the greater number of Survey respondents we included in 2018. While the percentage of dedicated dealers across our Big Six universe stood at 33% in last year’s Survey, that number rose to 36% in 2018. With the increasing number of acquisitions taking place and dealers adding additional lines, we had expected to see a decline in the number of dedicated dealers, but it seems that most of the acquisitions taking place are by dealers that are not dedicated. As has often been the case with dedicated dealers, the lower the revenues, the more likely they are to be dedicated. We found 25% of the dedicated dealers had revenues of $5 million or less.

This year, we saw a modest increase in the number of dedicated dealers compared with 2017, which we attribute to the greater number of Survey respondents we included in 2018. While the percentage of dedicated dealers across our Big Six universe stood at 33% in last year’s Survey, that number rose to 36% in 2018. With the increasing number of acquisitions taking place and dealers adding additional lines, we had expected to see a decline in the number of dedicated dealers, but it seems that most of the acquisitions taking place are by dealers that are not dedicated. As has often been the case with dedicated dealers, the lower the revenues, the more likely they are to be dedicated. We found 25% of the dedicated dealers had revenues of $5 million or less.

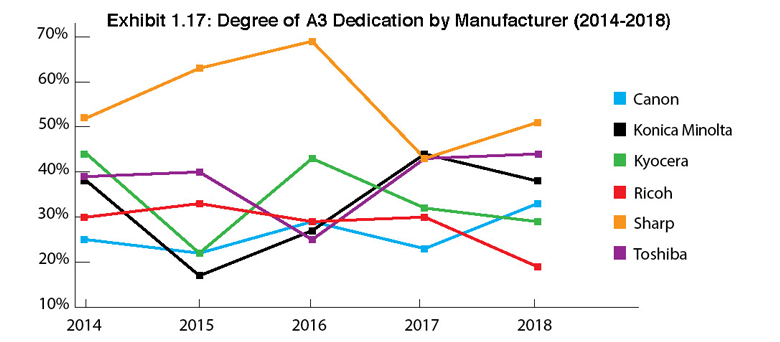

As has historically been the case, Sharp leads in the percentage of A3 dedicated dealers (51%) in this year’s Survey in which we had 71 Sharp dealers respond. This result is likely more reflective of Sharp’s dealer dedication, especially when compared to last year when that number was 42% when only 28 Sharp dealers participated in the Survey.

Toshiba ranked second in dealer dedication with 44% of dealers dedicated compared to last year when only 35% of Toshiba dealers said they were dedicated. One thing we’ve heard again and again from Toshiba dealers is that the company is responsive to their needs and in what’s become somewhat of a cliché in the industry, “easy to work with.” However, that positive reputation doesn’t necessarily explain why those dealers are dedicated. We attribute Toshiba’s high percentage of dedication to the fact that 35% of Toshiba’s dealers have revenues of less than $5 million. This implies that their customer base is mostly smaller accounts, which tends to be in the wheelhouse of dedicated dealers. Nonetheless, the number of dedicated Toshiba dealers is still an impressive percentage.

Konica Minolta also finished strong in the level of dealer dedication with 38% of the company’s dealers saying they were dedicated. It shouldn’t be all that surprising because the Konica Minolta line is broad enough to meet the needs of most dealers selling that brand. Despite a hefty number of dealers with significant revenues, Konica Minolta still had 24% of its dealers with revenues of less than $5 million.

The least dedicated dealers are those in the Ricoh Family Group (Lanier, Ricoh, Savin) where only 19% are dedicated. This can be attributed to the size of those dealerships, many of which have the resources to acquire, and in many instances, are acquiring competitive dealers or dealers carrying multiple lines. We don’t view Ricoh’s 19% of dedication as a negative, but rather we see it as a reflection of the trade-offs associated with well-heeled dealer representation.

Kyocera is another company worth discussing when it comes to dealer dedication. After Ricoh, Kyocera had the fewest percentage of dedicated dealers (29%), with 21% of total respondents reporting revenues of $5 million or less. At first blush, we would have expected both percentages to be higher as Kyocera ranks well behind Canon, Konica Minolta, and Ricoh in market share. Up until this year, Kyocera did not offer a production print device. Because of that factor, we might attribute Kyocera having the second lowest percentage of dedicated dealers with a need to align with a manufacturer that offers production equipment. However, with only 11 of the 58 Kyocera dealers participating in our Survey identifying Canon, Konica Minolta, or Ricoh””three OEMs with strong production print product lines””as a second, third, or fourth A3 line, the numbers don’t point in that direction. And just because they’re aligned with one of those three OEMs, it doesn’t mean they’re selling their production devices. What we can surmise by is that up until now, production print hasn’t been all that important to Kyocera dealers. This year, only 15 Kyocera dealers reported they engage in production print, although we suspect the number is lower based on the revenues of seven respondents with less than $3 million in revenues, and three of those with less than $1 million in revenues.

Another factor that could have an impact on dealer dedication is HP’s entry into the A3 space. At this point, HP’s impact is negligible at best. Currently, 12% of dealers identified HP as their secondary A3 line, but we expect to see that number grow. Among dealers representing the Big Six, Ricoh has the most dealers carrying HP’s A3 line with 21.6% of respondents (11 of 51). Sharp had 9.9% of respondents (seven of 71); Toshiba had 14.6% (seven of 48); Konica Minolta had 11.1% (six of 54); Canon had 12.5% (six of 48); and Kyocera had 5.2% (three of 58) carrying HP A3.

An interesting development we saw occur in early August was HP’s acquisition of Apogee Corporation, a large U.K. dealership””one of the largest in Europe. For any company looking to gain distribution, acquisition is one route to take, even if in this instance, HP has said the acquired dealer will continue to carry the same competitive lines it was carrying before the acquisition. It remains to be seen whether HP will take that path here in the U.S., but it is a development that merits monitoring, even if it won’t have an immediate impact on dealer dedication.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.