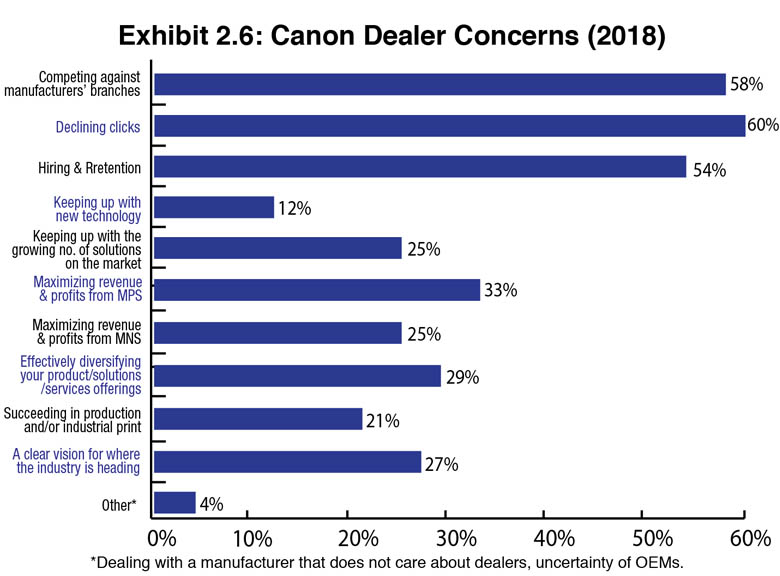

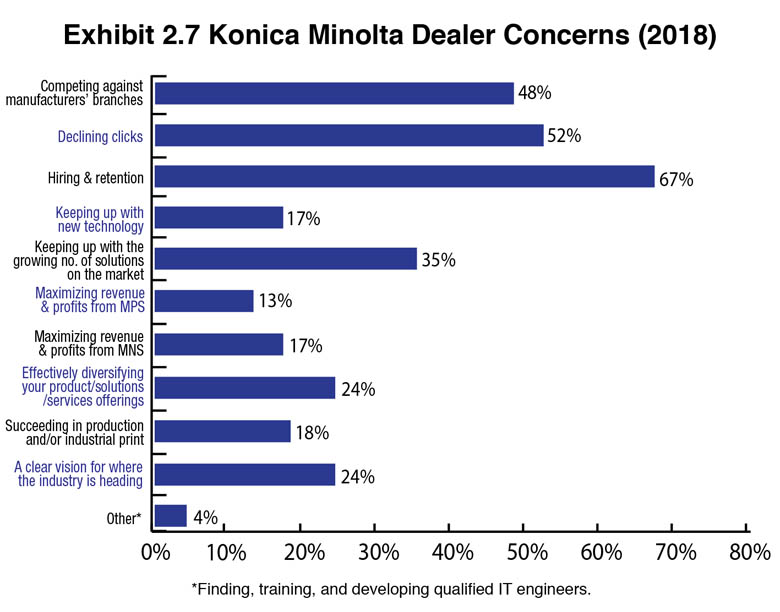

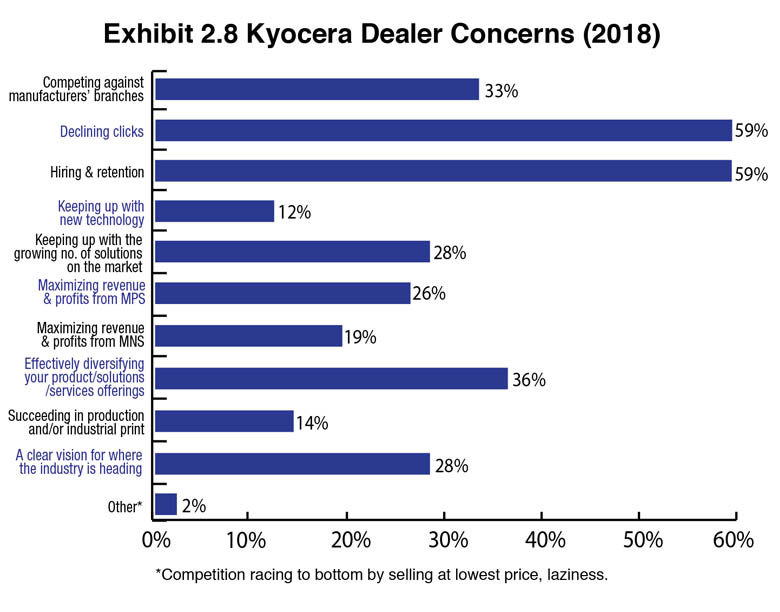

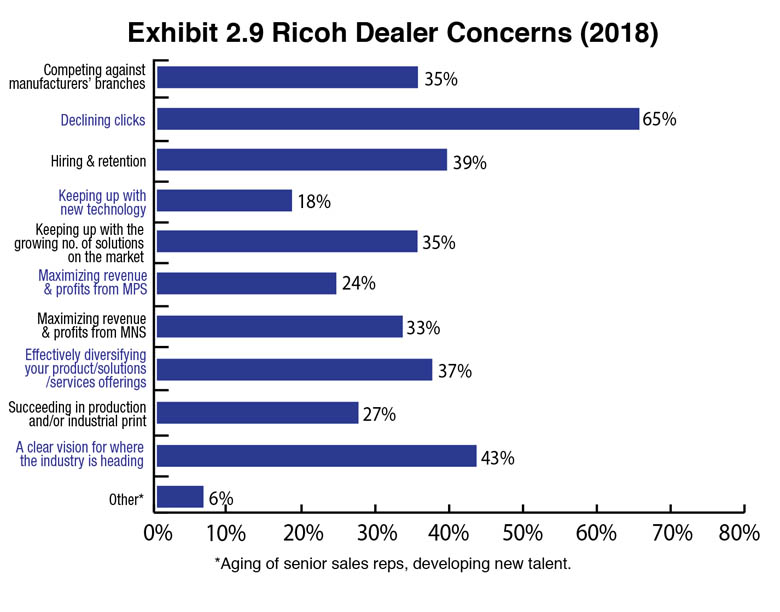

Exhibits 2.1-2.11

One of the more intriguing findings from our Survey is dealer concerns. Each year we ask dealers to identify their greatest concerns from a list of 10 options, as well as “other.” The areas of concern we asked dealers to choose from included:

- Competing against manufacturers’ branches

- Declining print clicks

- Hiring and retention

- Keeping up with new technology

- Keeping up with the growing number of solutions on the market

- Maximizing revenue and profits from MPS

- Maximizing revenue and profits from MNS

- Effectively diversifying your product/solutions/services offerings

- Succeeding in production and/or industrial print

- A clear vision for where the industry is heading

- Other

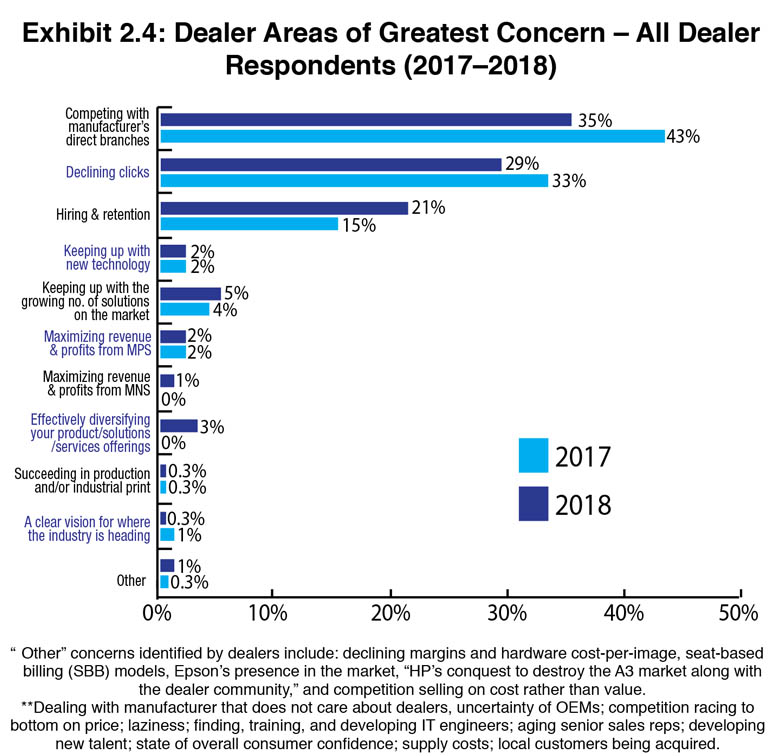

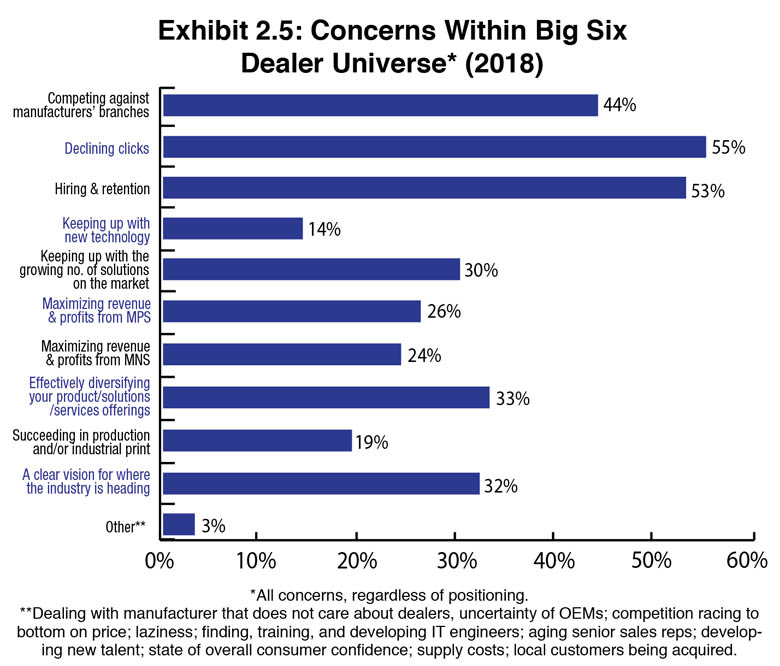

Only four dealers who participated in our Survey did not identify a concern. That’s only natural, particularly in a dynamic and ever-changing industry. This year, instead of asking dealers to identify their four top concerns, we allowed them to identify an unlimited number of concerns. The number of concerns noted ranged from zero to six concerns per dealer with approximately one-fifth of all respondents identifying more than four concerns. As a result, we’ve added additional charts to reflect the dealer concerns of each of the Big Six, as well charts for the top three concerns, and a chart that identifies the concerns of the entire Survey universe. We did not create a separate chart of concerns for “other” due to the small number of responses (8).

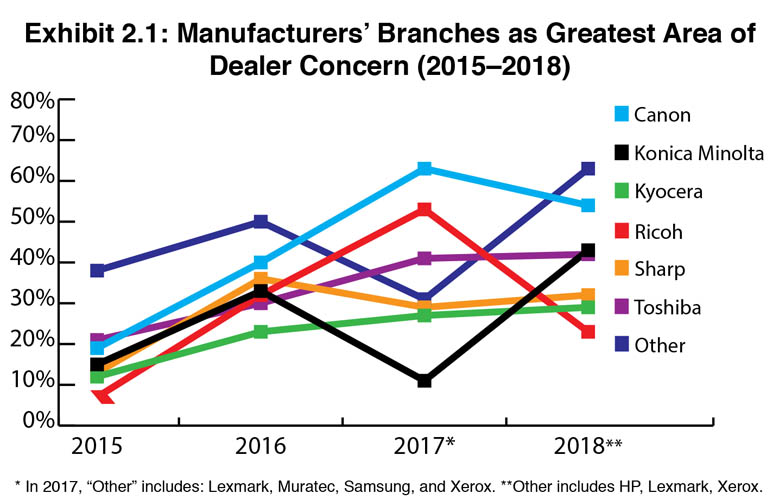

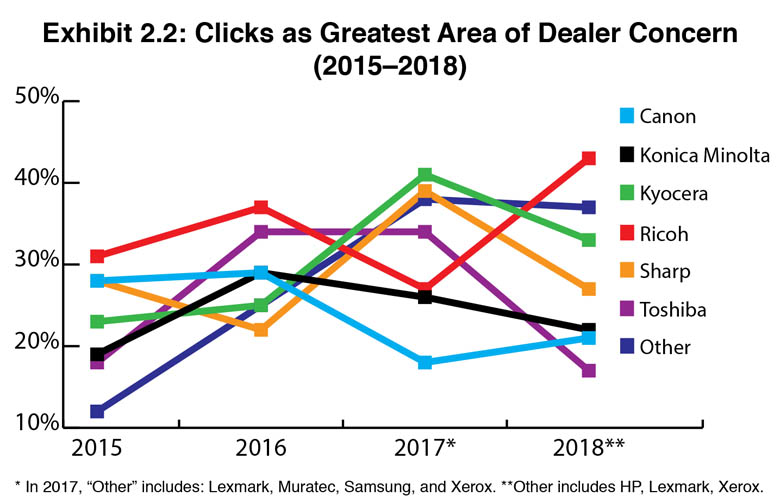

The top three concerns remain consistent with past years, with competition from manufacturer’s direct branches (35%), declining clicks (29%), and hiring and retention (21%) firmly entrenched in the top three as a primary concern (Exhibit 2.4). The numbers break out a little differently when we factor in all Big Six dealer concerns, regardless of positioning, in Exhibit 2.5. Here, the top three concerns are declining clicks (55%), hiring and retention (53%), and competition from direct branches (44%). Those are followed by diversification (33%), keeping up with the growing number of solutions on the market (30%), and maximizing revenue and profits from MPS (26%).

The need to diversify is driven by declining clicks, so it’s little wonder that diversification ranks so high among a dealer’s concerns. For those that have diversified or are looking to diversify, there’s a growing number of ways to do so. Consider production and industrial print, digital signage, managed IT, security, and based on a recent conversation with HP, device-as-a-service (DaaS), which might be best described as PCs-as-a-service. HP has seen PC sales rise of late and what it’s touting under a DaaS model is offering mid-market and SMBs the option of having resellers manage their PCs along with their print. We’re not sure if this is going to resonate with all those dealers in the channel that have signed on with HP as a Premier Partner, but from what HP tells us, there is a number of dealers that have between six and eight customers under DaaS contracts already.

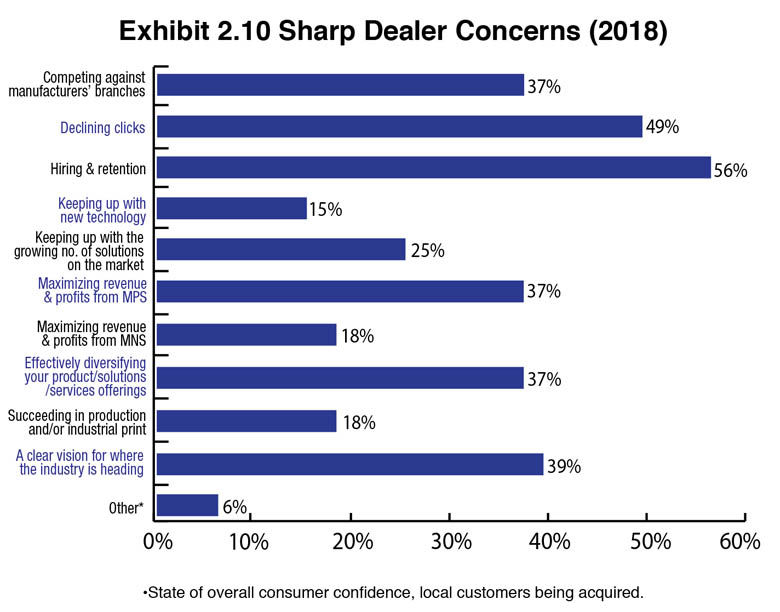

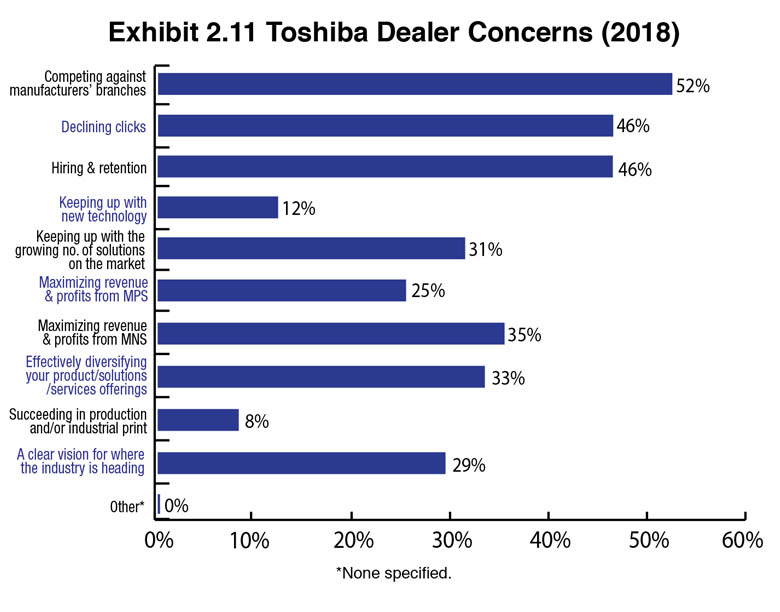

Reviewing the responses (Exhibits 2.6-2.11) reflecting the concerns of each of the Big Six regardless of positioning when listing those concerns, there’s the expected consistency among the top concerns although the order shifts depending on manufacturer. There were a few things we found interesting when examining the responses of some of the Big Six manufacturer’s dealers.

For example, Konica Minolta dealers’ top concern was competition from manufacturer direct branches with 43% identifying that as their primary concern, and a total of 48% across the Konica Minolta dealer universe identifying that as a concern. That’s trending higher this year compared to last year when 30% of Konica Minolta dealers identified that as their primary concern. We’re at a loss to explain the increase because Konica Minolta has made positive strides in alleviating many of the competitive issues related to direct branches during the past decade. Does this mean some of those issues are returning or are the overall percentages the result of multi-line Konica Minolta dealers expressing their concerns about another vendor?

With Kyocera entering the production print space this year, we were curious to see how dealers ranked this as a concern. Fully 14% identified succeeding in production and/or industrial print as a concern. Last year that was a concern for 9% of Kyocera dealers. We expect to see the number of Kyocera dealers concerned about succeeding in production print rise in next year’s survey after Kyocera begins shipping product and dealer are in the field trying to sell it. Kyocera ranks as one of the most app happy vendors in the industry, which we define as a solution, so it shouldn’t be surprising that keeping up with the number of solutions on the market was noted by 28% of all Kyocera dealers responding to our survey.

After Ricoh transferred its SMB MIF to a select group of dealers last year effectively eliminating much of the competition with its direct branches, we saw this concern drop significantly among Ricoh dealers in this year’s survey. Last year when we asked dealers to identify their Top 4 concerns, 50% of Ricoh dealers identified this as their top concern. This year competition from direct branches was selected by 35% of the entire Ricoh dealer universe in our survey with only 23% saying this was a primary concern, indicating moving the MIF has had a positive impact.

The third biggest concern among Sharp dealers was a clear direction of where the industry is heading (39%). This may reflect Sharp’s new ownership, it’s new leadership here in the U.S., and some interesting new products such as Smart Office Suite that the company is rolling out to the channel this fall.

Given our advocacy for production and industrial print, we thought it would be interesting to look at how much of a concern success in this segment is between the “haves” (Canon, Konica Minolta, Ricoh) and the “have nots” (Kyocera, Sharp, Toshiba). We elected to keep Kyocera in the “have not” category as its production print product won’t be available to Kyocera dealers until 2019. Here 22% of the “haves” identified this as a concern compared to 15% of the “have nots.” There wasn’t a huge gap between the two, but indicative nonetheless of the sentiments of those with access to a production/industrial print line and those without.

Only 3% of the 338 respondents identified “other” as a concern. Those other concerns are worth noting and encompass the following:

- The uncertainty of the OEMs.

- Dealing with a manufacturer that does not care about smaller dealers.

- Competitors are racing to the bottom, profits are declining due to competition, not embracing the technology and rather giving away product based on price.

- Finding and training, developing and retaining qualified IT engineers.

- Tightening hardware margins and declining service rates.

- Laziness.

- Aging of our senior sales reps; developing new talent to take over their accounts.

- The state of overall consumer confidence.

- Supply costs. [We get] no help from manufacturers when competing on competitive supply deals (CPP).

- Local customers being acquired.

Each of these are valid concerns, however, we believe tightening hardware margins and declining service rates are worthy of further scrutiny in future Surveys and we will add those to the list of concerns for dealers to choose from in next year’s Survey.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.