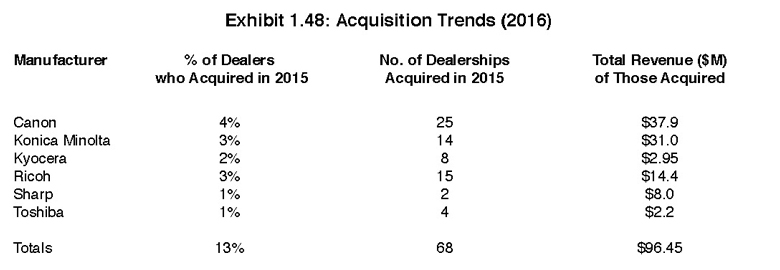

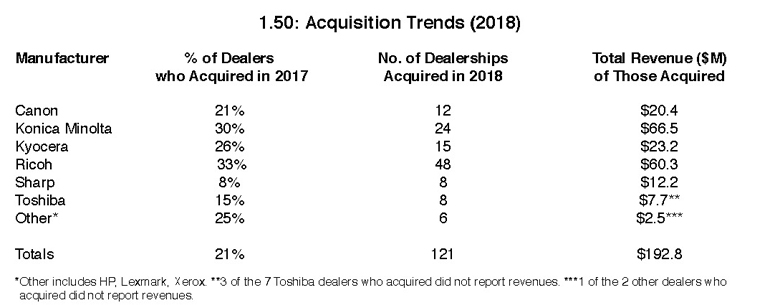

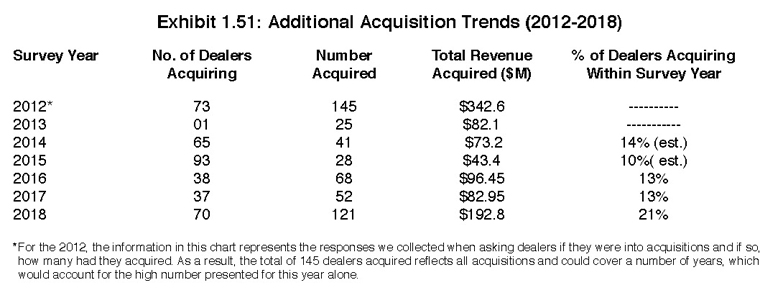

Exhibits 1.48″“1.51

Since we began conducting this Survey, there hasn’t been a single year where acquisitions were not shaping the dealer landscape in one way or another. The days of Global Imaging Systems, IKON, and Danka buying at a fast and furious pace have been superseded of late by private-equity money flowing into the channel, furiously funding the latest round of acquisitions. Larger dealerships are also using their own funds to acquire.

Since we began conducting this Survey, there hasn’t been a single year where acquisitions were not shaping the dealer landscape in one way or another. The days of Global Imaging Systems, IKON, and Danka buying at a fast and furious pace have been superseded of late by private-equity money flowing into the channel, furiously funding the latest round of acquisitions. Larger dealerships are also using their own funds to acquire.

Looking at the results of this year’s Survey, the number of acquisitions reported by respondents, while not exactly off the charts, showed much activity. A total of 21% of dealers (70) in our universe of 338 respondents acquired in 2017 (Exhibit 1.51). Those 70 dealers acquired 121 companies””mostly traditional office technology companies, but also including a handful of IT companies and telecom/phone systems companies. Most acquisitions were of smaller companies, with the average value of the acquired companies coming in at $1.7 million, up from $1.2 million a year ago. We’d like to note that some of the Ricoh dealers reporting acquisitions purchased Ricoh MIF from the company’s direct branches. When a respondent noted this in our Survey, we omitted those from our calculations, although it’s reasonable to assume some acquisitions attributed to Ricoh dealers in our Survey were Ricoh MIF.

Last year, nearly 50% of our Survey respondents reported acquisitions were in their plans for the following year and beyond. This year, that percentage jumped to 66% (222 dealers of our universe of 338 respondents to our Survey). We believe this uptick can be attributed to a combination of following the leaders (those big dealers who are acquiring like crazy) and a fight for survival, by acquiring such firms as IT companies and others, including telecom/phone systems companies, to expand a dealership’s product and services offerings to remain competitive and offset declining print volumes. Ricoh dealers’ posted the highest interest in acquisitions (78%), followed by Canon (67%), Konica Minolta (63%), and Sharp (56%). The least acquisitive dealers, which is more a reflection of their average dealership sizes, are Toshiba (50%) and Kyocera (47%). The “Other” category found 87 % (seven of eight dealers) with acquisitions in their plans.

As dealers continue to acquire, the regional footprint we’ve discussed in past Surveys continues to expand for many of the larger dealerships such as DEX Imaging, Marco, and POA, as well as others such as ACP in Colorado and Centric in Maryland. In some markets, acquisitions have depleted the market of independent dealerships. Two of the most notable examples are in Atlanta, where only three independents remain by our estimates, and in Denver, where one dealer essentially dominates the market with limited competition from one or two other independents and a handful of direct branches.

We expect this trend to continue unabated as the acquisition feeding frenzy continues. As we move forward, we’ll be closely following how these acquisitions shift the market landscape, especially when it comes to organizations now backed by private-equity funds. We continue to question what the end game is for an Oval Partners/FlexPrint and a Visual Edge. How much bigger can those organizations become before they decide to sell? If the intent is to eventually sell, then to whom? Another private-equity firm, one of the mega dealers, a manufacturer? At this point, no one is tipping their hand, so we’ll just have to wait a few years or more to see.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.