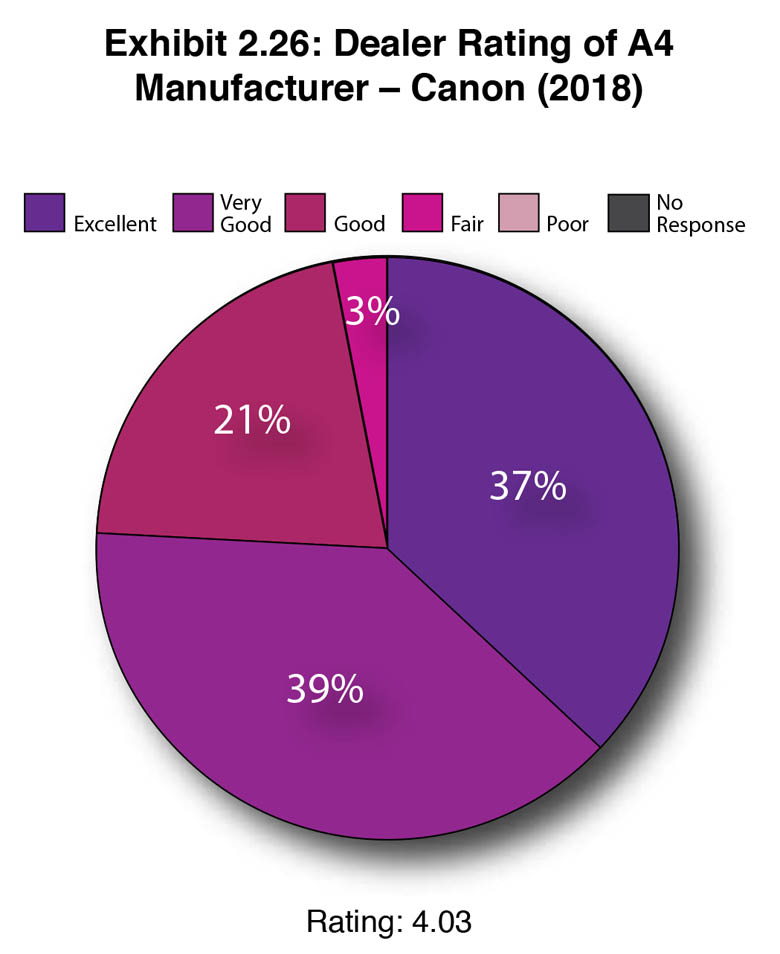

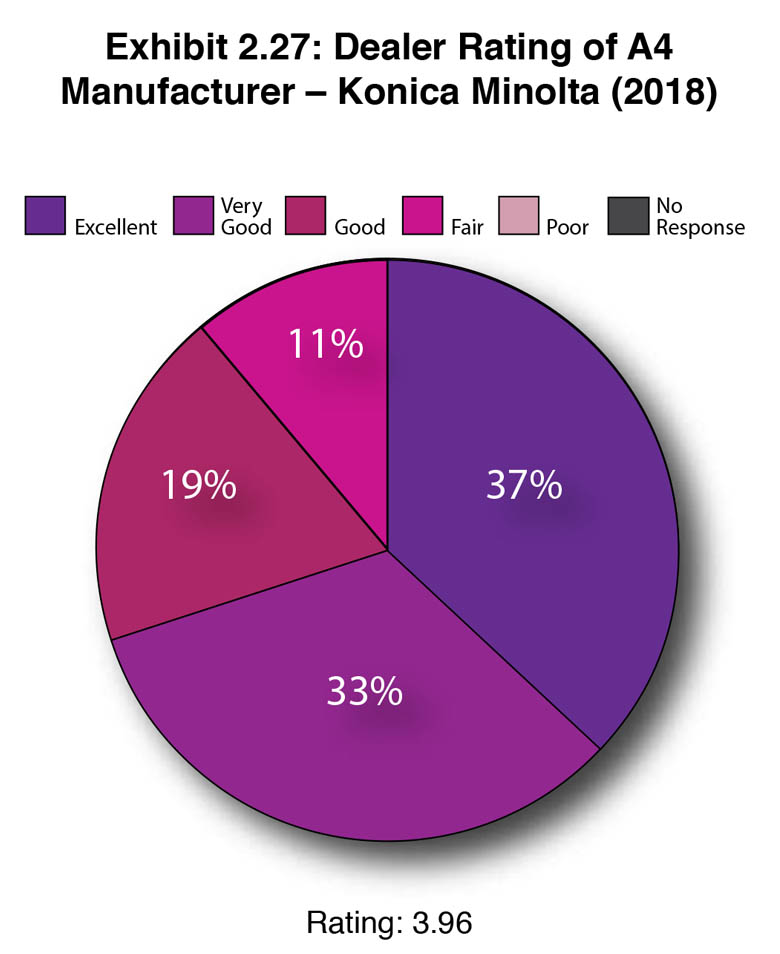

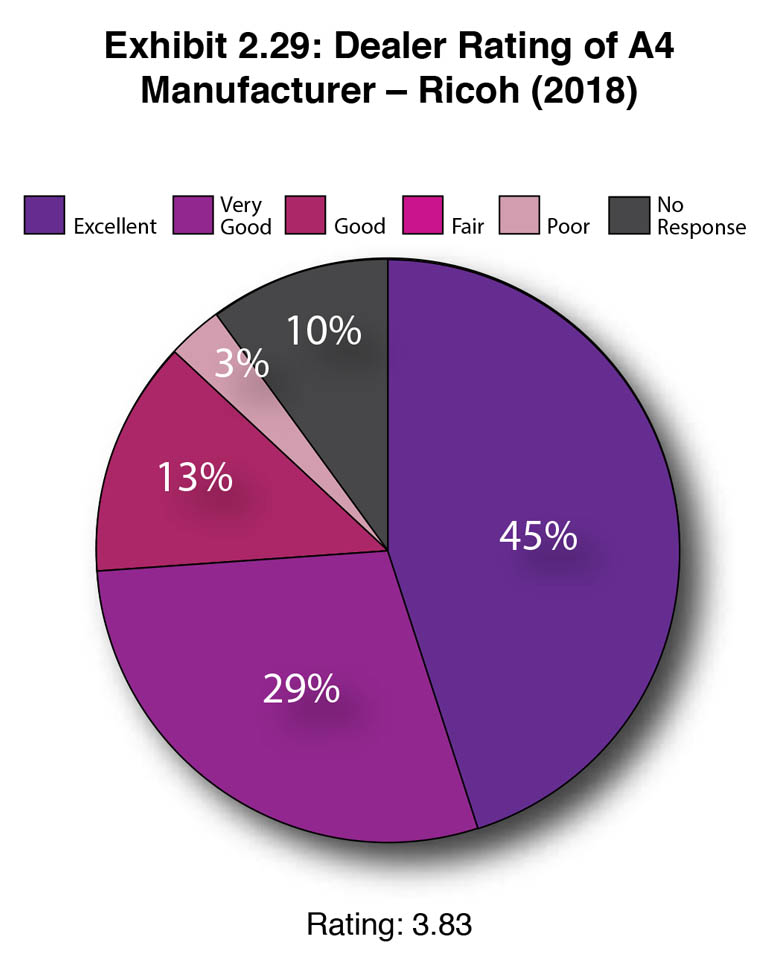

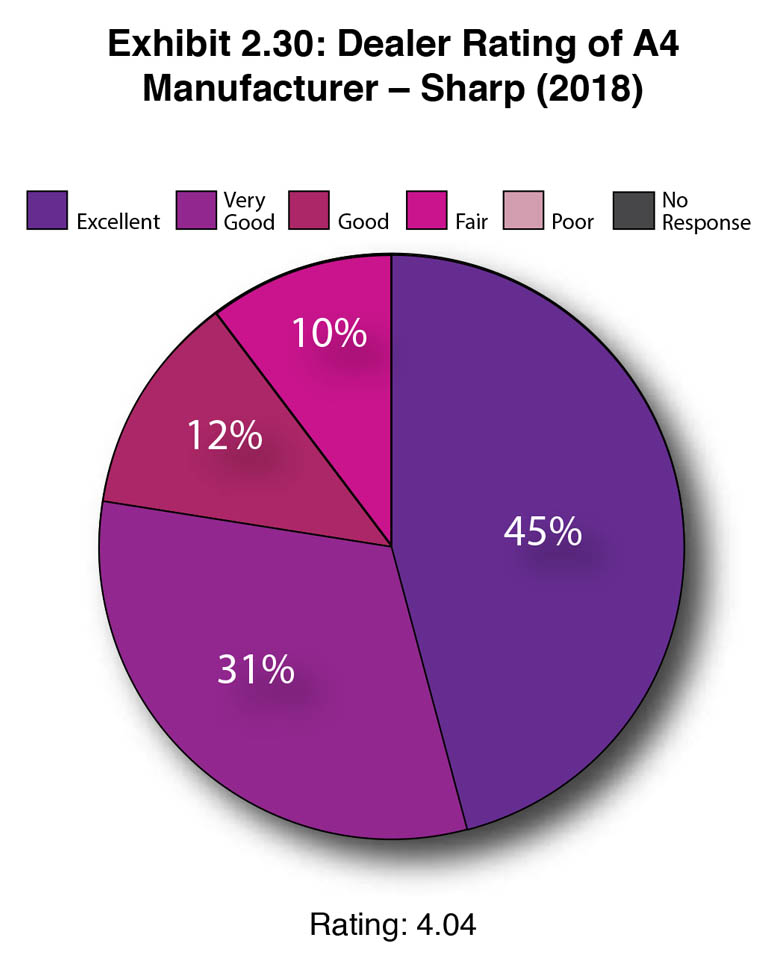

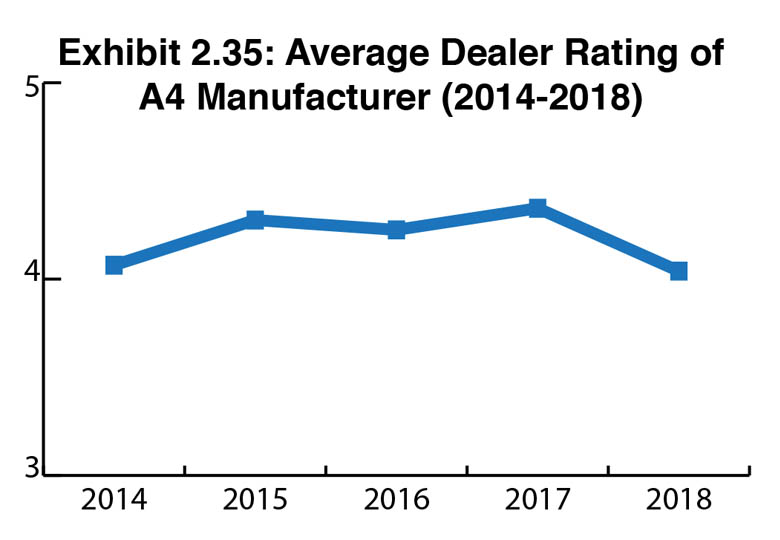

Exhibits 2.26-2.35

In addition to asking dealers to rate their A3 manufacturers, we asked them to rate their primary A4 manufacturers. With companies such as HP, Lexmark, and others offering A4 devices, dealers have plenty of options to choose from beyond the Big Six OEMs. Depending on which Big Six OEM the dealer is aligned with, a dealer may need to go outside of their primary A3 OEM to satisfy their A4 requirements, as not every Big Six OEM has a strong A4 offering.

After seeing declines in the percentages of dealers identifying one of the Big Six as their primary supplier from 72% in 2016 to 67% in 2017, that result rose to 75% this year. We attribute this swing to the higher number of Kyocera dealers participating in this year’s Survey””58 compared to 22 in 2017. All but four of those 58 dealers identified Kyocera as their primary A4 supplier.

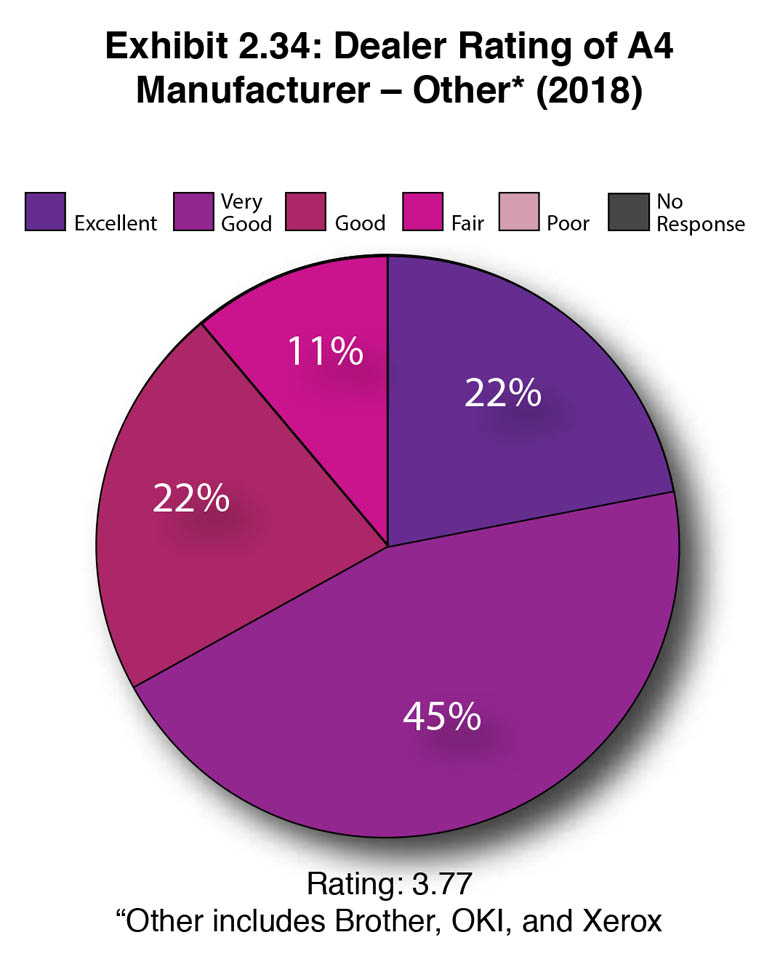

Another variation is in the “other” category. This year the “other” category includes Brother, OKI, and Xerox. Last year, Brother was not identified as a primary A4 supplier by any of our Survey respondents; however, Muratec and Samsung were. We now include the latter two in our ratings for Konica Minolta and HP, respectively. Because only nine dealers in our Survey identified one of those three companies as a primary A4 supplier””Brother, OKI, Xerox””readers may want to keep that in mind when viewing the ratings in Exhibit 2.34.

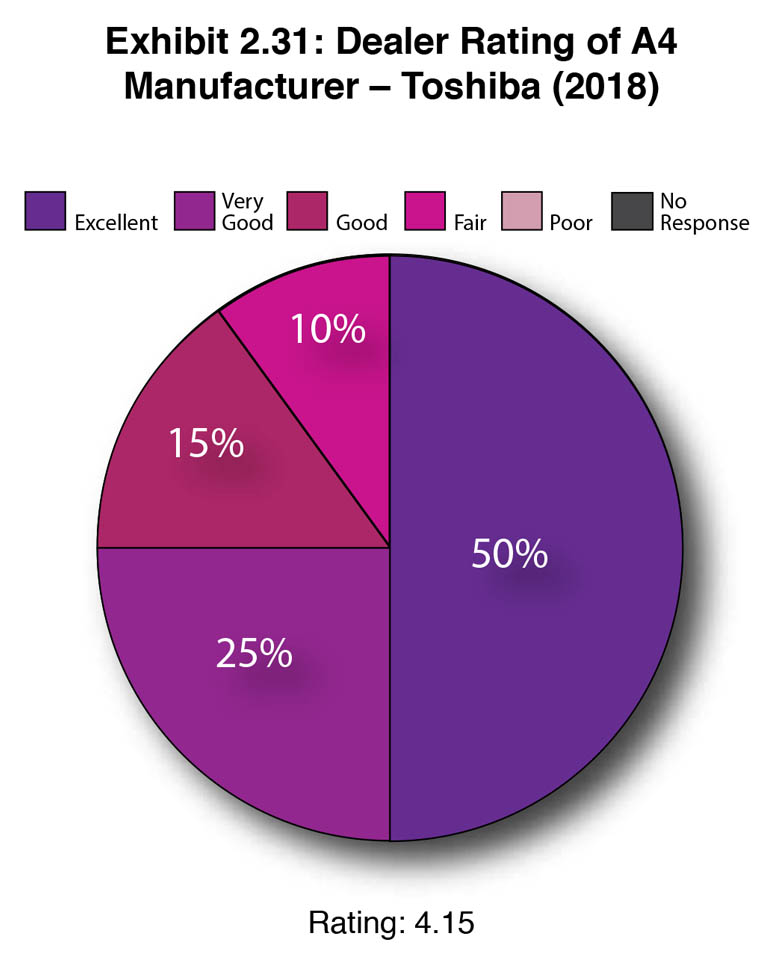

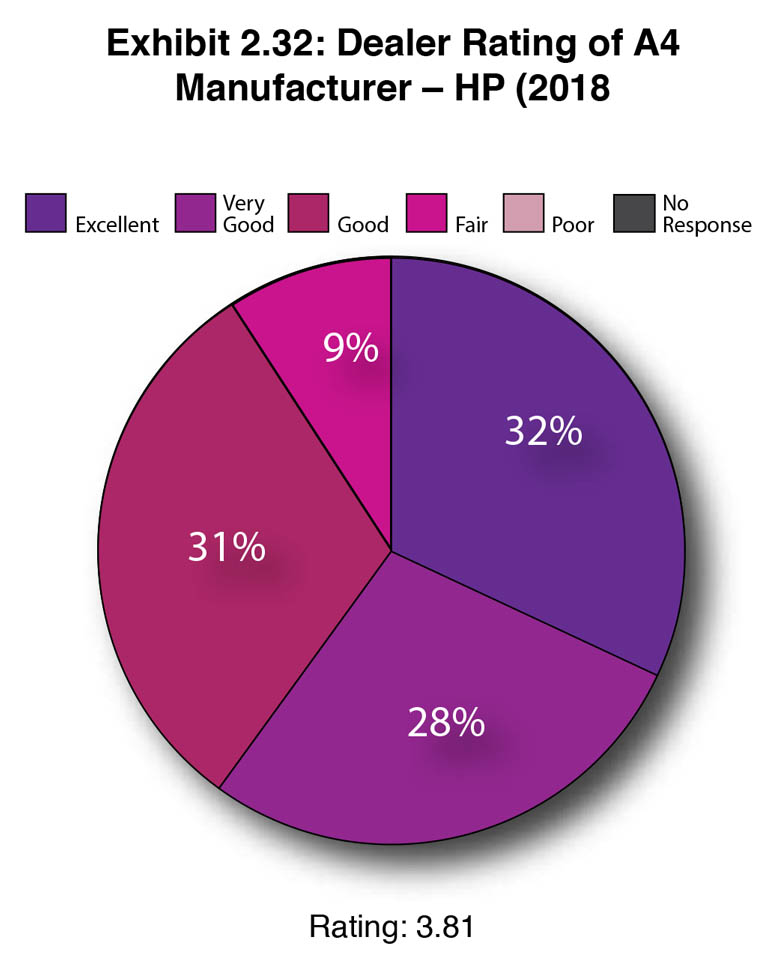

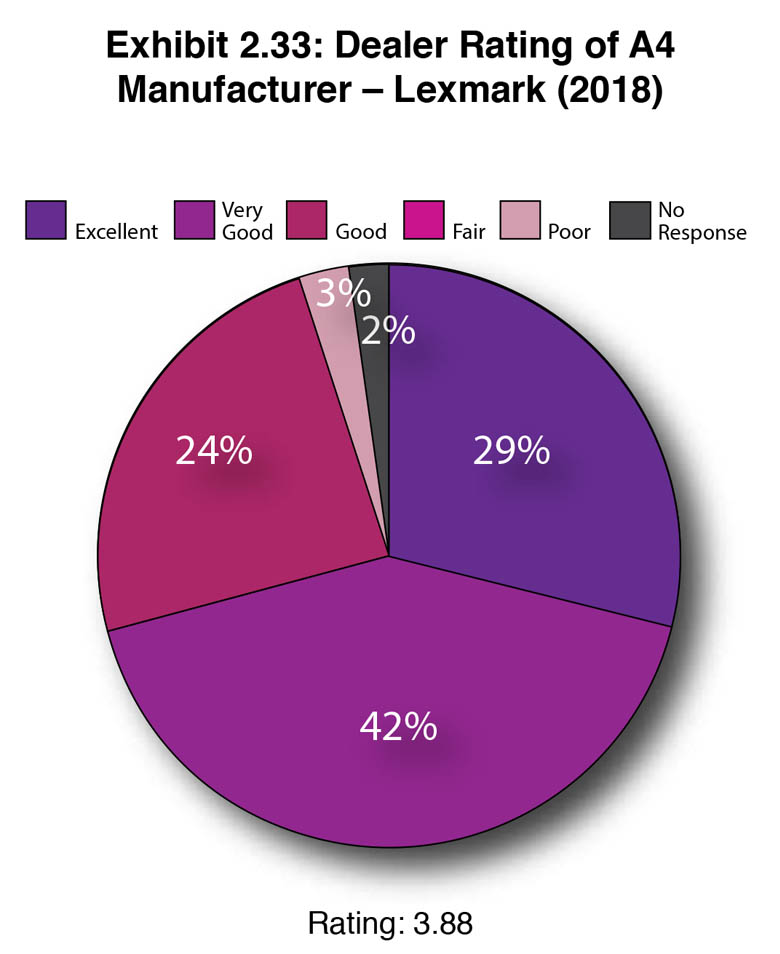

One variation between last year’s and this year’s Surveys is seen in the average rating of the A4 suppliers. This year, the average rating across all dealers ranking A4 suppliers was 3.98 compared to 4.08 in 2017, both out of a possible 5.0. The biggest decline was with Lexmark which dropped from 4.57 in 2017 to 3.88 this year. This decrease could possibly be attributed to the new ownership, or it could be a larger issue, based on a couple of harsh comments we’ve heard from dealers. In fairness to Lexmark, 17 dealers rated the company as “Excellent,” and 25 rated it “Very Good,” while 14 respondents rated Lexmark “Good.” However, we’d like to acknowledge there were some critical comments from the dealers that gave the company those “Good” ratings as well. Plus, most of our Survey results were received prior to the company’s Road Shows, which may have altered some of the views of dealers that submitted their Survey responses prior to attending one of those Road Shows. Still, it’s a significant drop from the previous year and we believe this trend warrants watching.

Looking at how the other vendors performed compared to the previous year, Canon dropped from 4.12 in 2017 to 4.03 this year; Konica Minolta dropped from 4.08 to 3.96; Kyocera fell from 4.54 to 4.36; Ricoh rose from 3.58 to 3.83; Sharp dropped from 4.14 to 4.04; Toshiba fell from 4.23 to 4.15; and HP rose from 3.56 to 3.81.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.