Exhibits 1.6″“1.9

At one time, dealers may have been kicking and screaming about adding A4 to their product mix because of the lower margins compared to A3, but despite our past predictions that A4 is a declining market, the evidence, or at least the numbers in this year’s Survey, prove us erroneous in that prognostication and we now see that A4 represents a golden opportunity for dealers. Margins may not always be what dealers selling A3 are accustomed to, but as one dealer told us, there’s a tremendous aftermarket.

At one time, dealers may have been kicking and screaming about adding A4 to their product mix because of the lower margins compared to A3, but despite our past predictions that A4 is a declining market, the evidence, or at least the numbers in this year’s Survey, prove us erroneous in that prognostication and we now see that A4 represents a golden opportunity for dealers. Margins may not always be what dealers selling A3 are accustomed to, but as one dealer told us, there’s a tremendous aftermarket.

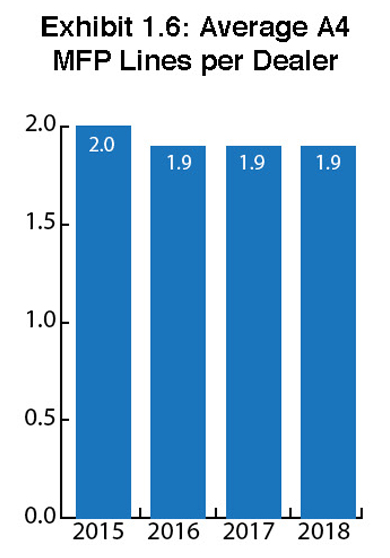

If you want to discuss consistency in our Survey, there’s no better place to see proof of that than with the average number of A4 MFP lines per dealer (Exhibit 1.6). For the past three years, that number has been holding steady at 1.9. In 2015, that number was 2.0.

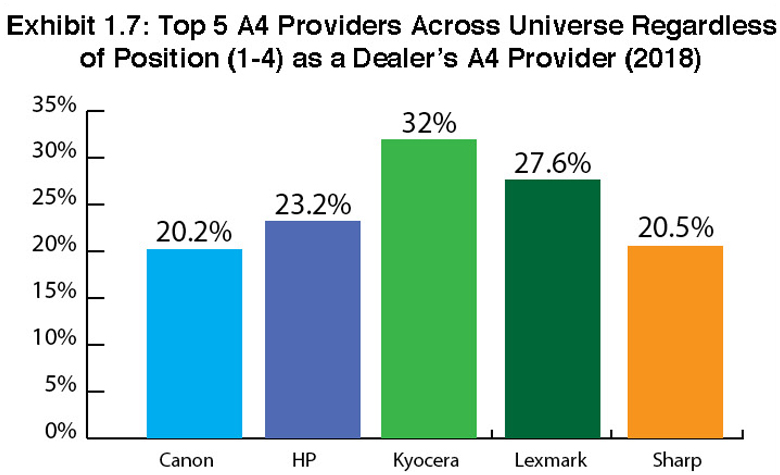

This year, we thought it would be compelling to identify the Top Five A4 brands regardless of whether it was a Big Six manufacturer or a secondary manufacturer and regardless of position as a dealer’s A4 provider (Exhibit 1.7). Topping the list was Kyocera with 32% of the

universe carrying that brand, followed by Lexmark at 27.6% and HP at 23.2%. The fourth and fifth positions were held by Sharp at 20.5% and Canon at 20.2%.

universe carrying that brand, followed by Lexmark at 27.6% and HP at 23.2%. The fourth and fifth positions were held by Sharp at 20.5% and Canon at 20.2%.

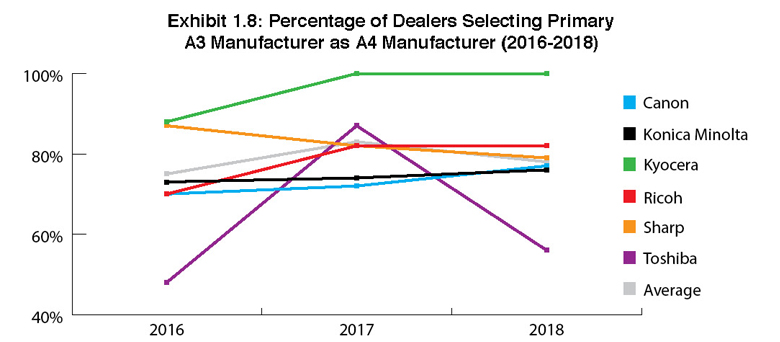

The percentage of dealers selecting their primary A3 manufacturer as an A4 manufacturer was mostly consistent with last year. The one deviation we saw was with Toshiba where that number dropped from 87% last year to 56% this year. We’re somewhat perplexed by that and initially wanted to attribute it to a strong showing by Lexmark, a long-time Toshiba partner, on the A4 side. However, only 42% of Toshiba dealers are carrying Lexmark A4 products, so our initial assumption didn’t necessarily explain the change from last year to this year. Digging a bit deeper, the percentage of Toshiba dealers carrying Toshiba A4 was 48% in 2016. So, on further reflection, we believe Toshiba dealers misreported their A4 manufacturer in our 2016 Survey, something we did suspect last year. The 56% result from 2018 seems to be more in line with the 48% reported in 2016. We’re looking forward to seeing what’s going to happen next year after the recent announcement by Toshiba that they will also be sourcing A4 devices from Brother.

Exhibit 1.9 highlights A4 suppliers not among the Big Six, some of which offer A3 products as well. This Exhibit has been revised since last year and no longer includes Muratec (now part of Konica Minolta) or Samsung (now HP) and includes two companies that weren’t included in last year’s Exhibit””Epson and Xerox. Because of that we are not including historical data for this exhibit as we did last year. As noted earlier, Lexmark and HP led the way, followed by OKI, Xerox, Brother, and Epson, among the vendors outside the Big Six identified by dealers as their A4 suppliers.

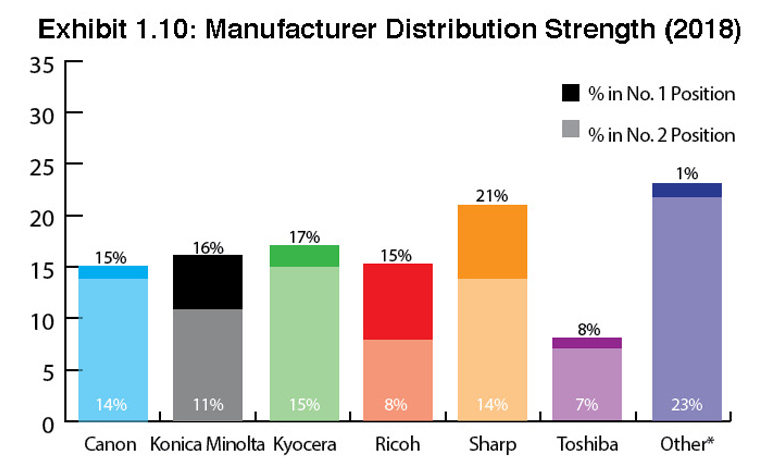

After acquiring Muratec last year, we expected Konica Minolta to enjoy a stronger showing as an A4 supplier in this year’s Survey. However, that did not happen as only 16% of our dealer respondents listed either Konica Minolta or Muratec as an A4 supplier. In 2016 and 2017, 6% of dealers identified Muratec as an A4 supplier.

The most notable change between the 2017 and 2018 Surveys involves Lexmark. In 2017, the company was at 12%, a drop of 7% from the 2016 Survey. This year, Lexmark came in at 17%. Considering all the turmoil the company has been going through, it doesn’t seem to have impacted the number of dealers that count on Lexmark as their primary A4 supplier.

Looking at Exhibit 1.9, the other notable difference between 2017 and 2018 is the performance of the newly combined HP and Samsung at 9.12%. That’s a bit of a drop off from the combined percentages of the two companies in our 2017 Survey, which came in at 20%. Those combined results could be due to the fallout from the acquisition, as some dealers that were carrying the Samsung line in the past are not being authorized to carry HP. Still, we believe HP remains in a strong position as an A4 MFP supplier, even though the company placed third or fourth in some dealership’s rankings of A4 suppliers.

Lastly, we’d like to note two companies that crept into the Top Five this year, Brother and Epson. Brother would have been tied with Muratec at 4% if we listed Muratec as an individual A4 MFP supplier, while Epson fell in at 1.25%, with just three dealers identifying the company as their primary A4 MFP supplier.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.