Exhibits 1.1″“1.5

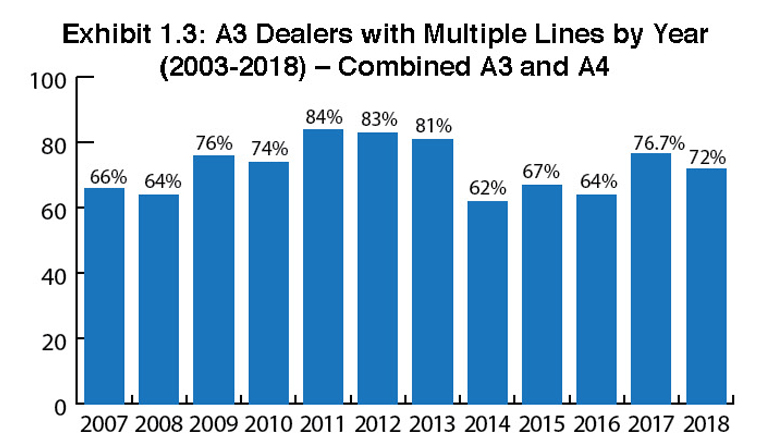

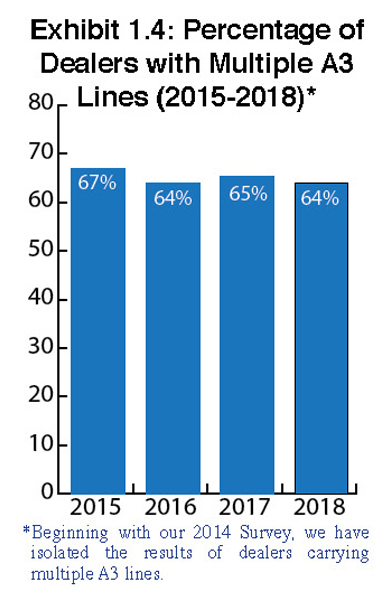

We started separating the A3 and A4 MFP lines with our 2014 Survey and continue to do so today. Prior to 2014, the number of lines per dealer was influenced by the number of dealers that selected an A4 MFP provider as their second, third, or fourth line. To continue showing a trend, we have included the chart for the combined A3 and A4 average MFP lines through 2013 (Exhibit 1.1).

We started separating the A3 and A4 MFP lines with our 2014 Survey and continue to do so today. Prior to 2014, the number of lines per dealer was influenced by the number of dealers that selected an A4 MFP provider as their second, third, or fourth line. To continue showing a trend, we have included the chart for the combined A3 and A4 average MFP lines through 2013 (Exhibit 1.1).

By separating the two product lines, we can better illustrate how A4 MFPs are impacting the dealer channel, and better show the strength or weakness of an A3 manufacturer’s distribution.

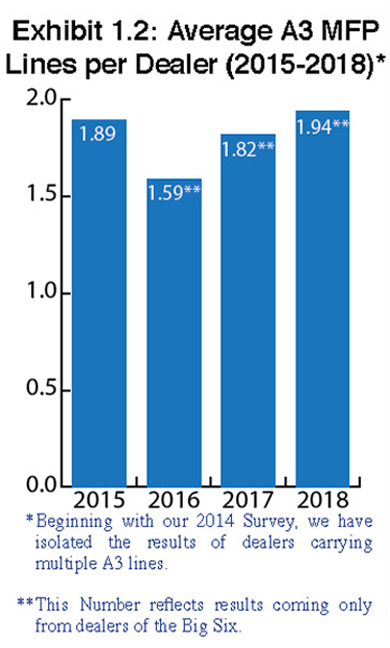

In this year’s Survey, a total of 637 A3 MFP lines were reported across respondents from the Big Six dealer universe, comprising dealers representing Canon, Konica Minolta, Kyocera, Ricoh, and Sharp. The average number of lines per dealer for that Big Six universe is 1.94 (1.91 when including dealers representing HP, Lexmark, and Xerox), an increase from 1.82 in our 2017 Survey.

We attribute the variation from 2017 to 2018 to a greater number of Survey respondents, as well as the continued impact acquisitions are having on the channel as dealers acquire and take on additional lines as the result of the

acquisitions.

acquisitions.

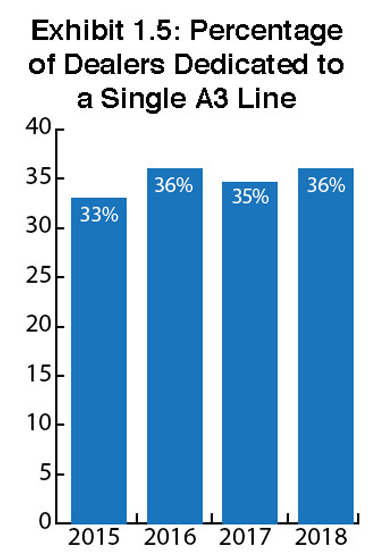

The challenge dealers’ carrying multiple lines face is identifying a niche for these additional lines. Some dealerships such as Pacific Office Automation (POA) in Portland, Oregon, have separate sales forces for each brand they carry. Granted, that is easier for a dealership the size of POA to do than a mid-sized dealer with a smaller sales force. However, when a line added through an acquisition has a strong presence in the acquired dealer’s market, keeping an existing sales force in place when acquiring an additional line is often beneficial.

Let’s not overlook the impact HP may have in our Survey going forward as the manufacturer continues to sign on dealers to carry its A3 line. Whether or not HP will be an additional line for these dealers or if it will supplant an existing A3 line remains to be seen, but we believe HP’s future presence in the A3 space will continue to grow.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.