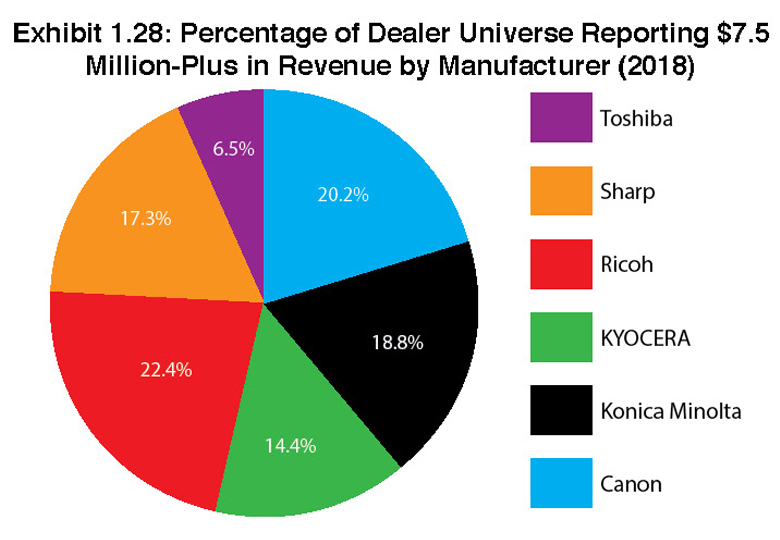

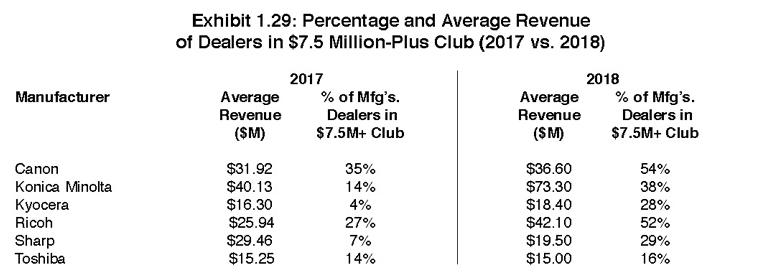

Exhibits 1.28″“1.29

Up until our 32nd Annual Dealer Survey in 2017, we tracked the numbers for the $5 Million-Plus Club, dealers with revenues of $5 million or greater. During the early years of our Survey, the average dealer revenue was in the $7- to $8-million range. At that time, we felt a dealer with revenues of $5 million and above had adequate resources to compete effectively. Last year, we upped the ante, creating the $7.5 Million-Plus Club to reflect changes in average dealer revenue and what we felt were the resources necessary to grow and expand into services. This isn’t to say that a dealer with less than $7.5 million in revenues can’t expand into new, growing areas or even acquire. Though, it’s a more likely strategy for a dealer with $7.5 million-plus in revenues to pursue in this era of expanding solutions and services.

Exhibit 1.28 shows the percentage of our dealer universe reporting revenues greater than $7.5 million in by manufacturer, while Exhibit 1.29 reveals the percentage and average revenue of dealers in the $7.5 Million-Plus Club by manufacturer. In our 2017 Survey exhibits, we had included a separate column accounting for those dealers with over $5 million in revenues. This year, however we have eliminated references to the $5 Million-Plus dealers, as we chose to focus exclusively on dealers with more than $7.5 million in revenues.

It’s no surprise Canon, Ricoh, and Konica Minolta dealers rank in the top three, respectively, in terms of highest average revenue (Exhibit 1.28). What was surprising to us is how the average revenue increased for Canon, Konica Minolta, Kyocera, and Ricoh dealers. In Konica Minolta’s case, the average revenue increased from $40.13 million to $73.3 million, buoyed by four $100 million-plus dealers, including one that did not participate in the Survey last year. We were also surprised by the strong showing of Kyocera, as these dealers’ average revenues rose from $16.3 million in 2017 to $18.4 million this year. We would have thought with greater participation from Kyocera dealers in this year’s Survey, those numbers would have remained stable or fallen slightly, but the results show the opposite. We did observe a noticeable decline in the average revenue attributed to Sharp dealers from $29.46 million in 2017 to $19.5 million this year. We are attributing that decline to greater participation in the Survey among Sharp dealers, particularly by those with less than $10 million a year in revenues.

The average revenues for dealers representing the Big Six in $7.5 Million-Plus Club is $33 million, compared to $26.5 million in last year’s Survey.

We suspect going forward the average revenue of dealers that identify Canon, Konica Minolta, and Ricoh as their primary suppliers will continue to rise, as those companies offer their dealers a broad range of products, solutions, and services. It’s equally likely that as Kyocera has moved into the production space and is looking to gain a foothold with its ECM offerings, there’s strong potential for dealers that identify Kyocera as their primary supplier to increase their revenues as well. And we wouldn’t count Sharp out either, as the company rolls out new products such as the Smart Office Suite, which may take time, but could have a positive impact on its dealers’ bottom lines. More uncertain is Toshiba, which despite being one of the best companies to do business with, according to many Toshiba dealers, will be challenged to keep up with the other members of the Big Six consortium. With its eyes fixed on capturing market share in the A3 space, HP is also poised to present hurdles for Toshiba.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.