Exhibits 1.20-1.22

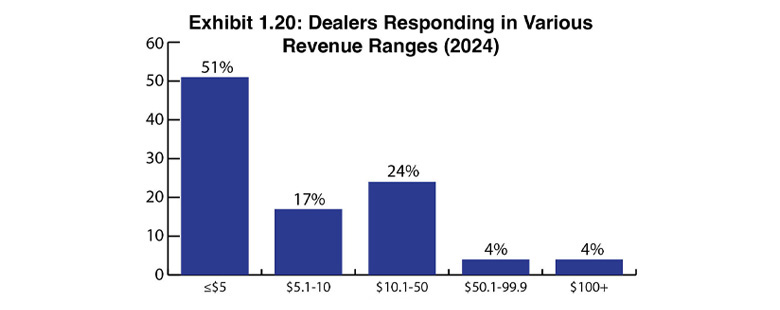

Since 2019, we’ve been tracking dealers with revenues of $10 million or greater, calling it the “$10 Million-Plus Club.” Before then, we focused on dealers with revenues of $7.5 million and higher from 2017 through 2018, and before that, dealers with revenues of $5 million and higher. The reason for tracking dealers in these revenue ranges was that we believed they were financially capable of investing in new products and services to grow the business and/or expand through acquisition. As the average dealer revenue has grown from more than $15 million in 2015 to $22 million today, we felt it was necessary to make the club even more exclusive, particularly as it has become more challenging for dealers with less than $10 million in revenue to grow their businesses. Even though some dealers with revenues of less than $10 million a year have shown that they can expand, we still believe the $10 million threshold is more realistic for growing a business.

Also, dealers with revenues of less than $10 million are prime targets for acquisition. As acquisition activity has increased, we expected buyers to be more discriminating, focusing on dealerships above $5 million in yearly revenues and with an existing machines in the field (MIF) to accelerate the acquirer’s growth targets. However, that’s not been the case. Most acquisitions of office technology dealerships are still smaller dealers with revenues well under $5 million. For example, the average revenue of the acquired companies in this year’s Survey was $2.7 million. It was $1.7 million a year ago, down from $3.7 million in 2022.

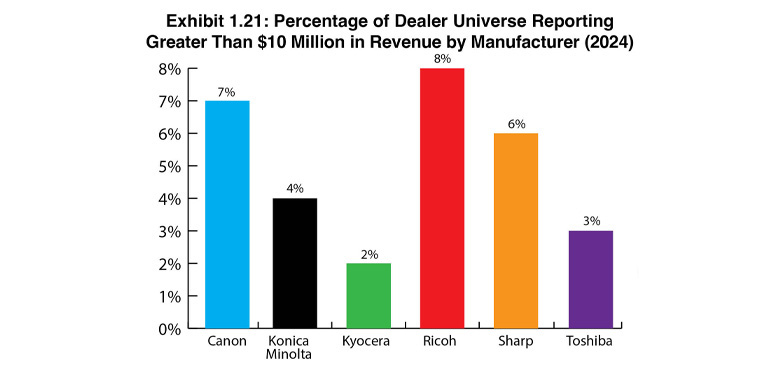

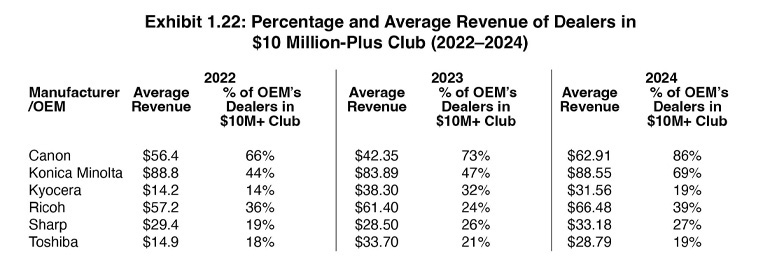

Until this year, the percentage of dealers in the $10 Million-Plus Club representing each of the Big Six OEMs has been growing and continued to grow during the pandemic. This year, we noticed some declines. Exhibit 1.21 identifies the percentage of our dealer universe reporting revenues greater than $10 million by manufacturer (across all 401 dealer respondents), while Exhibit 1.22 indicates the percentage and average revenue of dealers in the $10 Million-Plus Club by manufacturer. Konica Minolta, Kyocera, and Toshiba saw the percentage of dealers with revenues of $10 million or higher experience modest declines from the previous year. In contrast, the percentage of Canon, Ricoh, and Sharp dealers with revenues over $10 million showed modest increases. This year, 32% of dealers (126) reported revenues of $10 million or more, a 1% increase from last year. Three years ago, 45% (172 dealers) reported revenue of over $10 million; two years ago, that percentage was 33% (125 dealers). Up or down, the percentages of the past two years aren’t significant enough to identify any noticeable trend.

Konica Minolta ($88.55 million), Ricoh ($66.48 million), and Canon ($62.91 million) dealers continue to rank in the top three in terms of the highest average revenue (Exhibit 1.22). The average revenue for dealers representing the Big Six in the $10 Million-Plus Club is $51.96 million, down from $53.27 million a year ago. We attribute the difference in average revenue across the board to some of the mega and private equity owned dealers, such as DEX Imaging and Flex Technology Group, who didn’t participate in the Survey this year; we estimate that each has yearly revenues of well over $400 million. With that in mind, average yearly revenues in the $10 Million-Plus Club continue to rise, especially when one looks at the Survey results from two and three years ago, when the average for this group was $43.5 million and $32.4 million, respectively. It’s safe to say, and the overall Survey revenue numbers show it, the big dealers keep getting bigger.